In this month’s update…

April 2025 Performance

The Multi 100: Different Strategies. New Markets. Big Results.

Multi 100 FAQs

Did You Know?

Performance Review

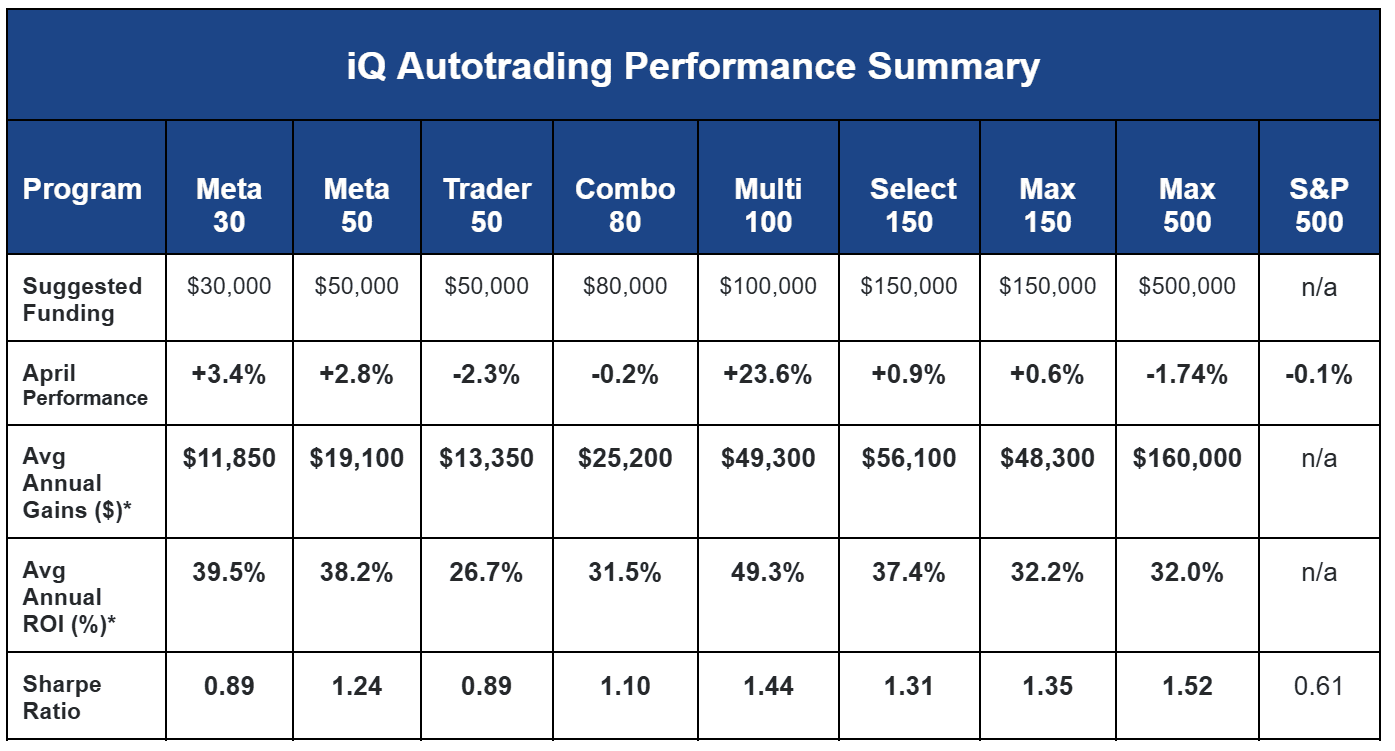

April 2025 was a tumultuous month for U.S. equity markets, marked by extraordinary political and geopolitical upheaval and two-way volatility. The S&P 500 (SPX) ultimately finished flat (-.1%) while experiencing levels of instability that, by some metrics, have never happened before. For example, including overnight trading, the average daily ranges reached extraordinary, record levels–more than 50% higher than experienced during the 2020 Covid Crisis.

While volatility is typically our friend, on the rare occasions when unprecedented levels are reached, our programs automatically slow down and sometimes temporarily pause themselves. This adaptive risk management technique kept our signal volume lighter than usual in April, but enough to record profits in 5 of the 8 programs. The leader of the pack was our recently released Multi 100 whose expansive diversification enabled it to generate an impressive +23.6% for the month.

* Returns based on live and simulated results since 2018, using suggested funding. Does not include license fees – which start at $3,900 - see pricing below. View full performance & disclaimers here. Source for S&P 500 Sharpe ratio is Morningstar based on past 5 years as of Dec 2024. Past performance may not be indicative of future results.

The Multi 100: Different Strategies. New Markets. Big Results.

Over the years, we’ve built our reputation by delivering portfolio diversification through the unique advantages of automated intraday trading. However, we’ve consistently heard requests for a more diversified approach—one that could trade multiple markets simultaneously, across any timeframe (from intraday to multi-month), and in both directions. Early last year, we began searching for strategies with long track records that could be paired with our most advanced intraday models to create our most diversified program to date. It wasn’t easy, but we found the right fit and began live trading in October—with strong results. Last month, we proudly made the iQ Multi 100 publicly available.

The Multi 100 is a professionally designed autotrading program engineered to capture some of the largest trends in the futures markets. By combining intraday and multi-day strategies across a diverse set of lowly correlated futures markets, the Multi 100 can produce outsized returns with reasonable risk. It trades approximately 10 global markets, including index futures, energy, metals, bonds, currencies and agricultural commodities. This cross-market approach enables Multi 100 to find more opportunities and benefit from moves in a variety of asset classes, around the clock.

Multi 100 is not just another trading system. We created it for ourselves and like-minded investors seeking:

Aggressive, asymmetric return potential

Diversification using strong trending markets

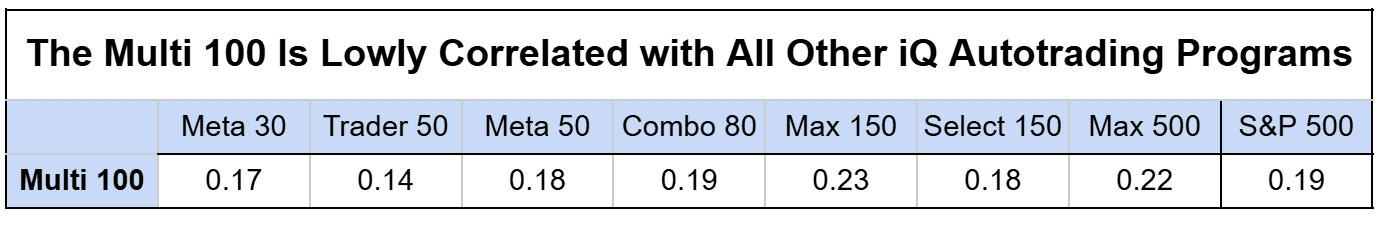

Low correlation to equities and iQ’s intraday programs

Fully automated, hands-free execution

Defined risk controls

Each trade in the Multi 100 is backed by systematic, data-validated logic. It only trades when a clear, historical edge is present. And because it combines short-termagility with longer-hold conviction, Multi 100 adapts fluidly to both fast markets and trending conditions.

Reminder: All trading and investment programs experience ups and downs, and investors should use risk capital and take a long-term approach for optimal results.

Frequently Asked Questions: Multi 100

What’s the funding level?

We suggest using $100,000, but you may start with less with broker approval.

What type of strategies does it use?

It uses a mix of intraday and multi-day trend following, momentum and mean reversion strategies to trade both long and short, whenever the best opportunities are present.

What markets does it trade?

In live trading it has held positions in currency and index futures, metals, energy, agricultural commodities and more. The Multi-100 could trade additional markets in the future as trends and opportunities present themselves.

How often does it trade?

~200/yr, but can vary a lot year-to-year depending on market conditions.

What can you tell me about the part of the program developed by iQ?

It uses our next generation / latest machine-learning (ML) technology and trades intraday only. It trades the Nasdaq futures (NQ), but could day trade other markets in the future. Its maximum daily risk budget is $4k.

Are the Multi 100 strategies traded in any other iQ programs?

The intraday portion of the Multi 100 can also trade in the Max 500 if the signal is generated on a day in which there is risk budget available.

Is this a good time to get started? What’s happened after large winning months in the past?

Historically, strong performance in a breakout month has often been followed by continued gains in the months that follow. This pattern likely reflects the program's ability to recognize emerging trends and capitalize on expanding opportunities across additional markets. If you examine the monthly returns, there have been 19 months that have produced in excess of 10% gains for the month. The average 6 month performance following the 10%+ month was +32.1%.

What’s the annual license fee?

The Multi 100 is available in May for the introductory price of $8,700.

Where can I see performance and learn more?

View Performance and Learn More About the Multi 100

Did You Know?

The Multi 100 is InvestiQuant’s least correlated program relative to our other intraday strategies—and it also shows minimal correlation with the S&P 500 (0.19 correlation).

iQ Autotrading programs are licensed annually and prices start at $3,900. Request details and payment options here. Discounts are available for veterans of the military and law enforcement. Larger programs and volume discounts are available for family offices and investors seeking to invest with greater amounts. Email [email protected] for details.

Client referrals are one of our top generators of new clients. Make an intro and we’ll do the rest. You both will save $500. Contact [email protected] for details.Want To Learn More?

Check out Answers to Common Autotrading Questions here. If you would like to request a 1-1 call/meeting with Matt, email [email protected]. You can also schedule a Zoom call/meeting with me here.

Thought of the Month

"

“You don’t wait for the market to feel right. If your system is tested and your rules are clear, you trade when the signals fire, even after a loss.”

– Jerry Parker

Scott Andrews

InvestiQuant.com

CEO & Co-Founder