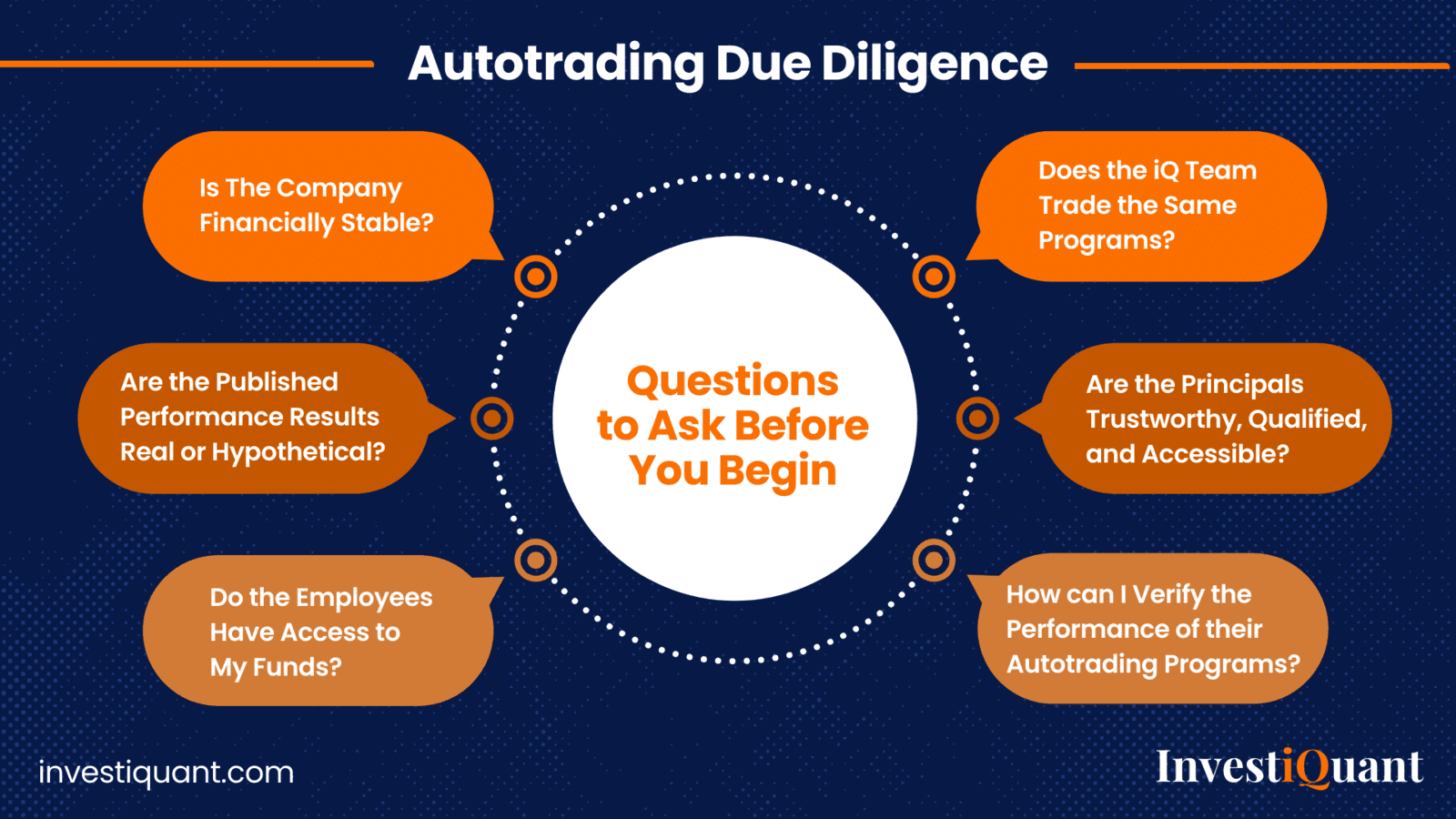

Due diligence is critical when selecting an Autotrading solution. Why? Because these days just about anyone with a little coding and trading knowledge can create a seemingly profitable automated trading solution. But subscribing based on attractive results is simply not enough. It takes a well-funded, fully-committed team of highly skilled developers and veteran traders to build and support automated trading strategies that can generate real profits in live trading over the long term. By conducting autotrading due diligence, you can better understand the risks, make a more informed decision, and increase the likelihood of achieving your financial goals.

The purpose of this article is to streamline some of the more important questions with some straightforward answers. InvestiQuant is a trusted partner of our clients with AI-driven automated solutions to guide clients in the diversification and growth of their wealth. Our objective is to help you decide if autotrading is right for you and to arm you with the information needed to make the optimal investment allocation decision for your financial situation and risk tolerance. If you have any other questions not covered in this blog, just reach out to us - we are here to help.

Does the iQ Team Trade the Same Programs?

Yes! We risk our own capital and rely on the very same strategies and programs as those traded by our clients.

Is The Company Financially Stable?

Yes. InvestiQuant is a profitable company that has been serving clients since 2008 and is backed by a large group of private investors. These shareholders (professional investors, friends and family, and about 20 of our earliest clients) invested over $3 million to help scale and automate the company’s innovative machine learning technology and strategies. With their backing, a strong balance sheet, and highly scalable business model, clients can rest assured that iQ is a company they can count on.

Are The Principals Trustworthy, Qualified and Accessible?

InvestiQuant’s principals, Scott and David, are highly experienced traders and software development professionals. They met while attending the United States Military Academy (West Point) and were subsequently stationed at Fort Bragg, NC (Scott served with the 18th Aviation Brigade and David with the 7th Special Forces Group.) After leaving the Army, they earned Masters degrees and led the development and launch of Jaggaer (formerly known as SciQuest) - one of the first B2B software-as-a-service pioneers and a global leader in e-procurement with over 1,000 employees today. With Scott at the helm, they took this cloud-based software company public on the NASDAQ exchange.

Following Jaggaer, they applied their passion for data to the financial markets and built InvestiQuant. Along the way, they became professional traders with Series 3 Commodities and Futures licenses. To earn their licenses and manage money professionally, they had to pass the rigorous National Futures Association (NFA) and Commodities Future Trading Commission (CFTC) background checks and derivatives qualification exams. (Note: the company is now registration-exempt so their licenses have expired.)

As CEO of InvestiQuant, Scott speaks with clients and prospects, and responds to emails on a daily basis. He can be reached at Scott @ investiquant dot com.

Are The Published Performance Results Real? or Hypothetical?

Unlike many 3rd party developers, we don’t hide behind hypothetical results and disclaimers which can be incredibly misleading and dangerous. Every InvestiQuant program’s live net trading results are shared from inception, typically along with simulated (hypothetical) returns for a few years prior, so that a more complete picture of how a strategy would have performed in other market environments can be assessed.

Please know that relying solely on hypothetical results - without live trading confirmation - is <highly> risky as simulated results are often over-optimized and rarely account fully for real world execution slippage. If the program trades frequently, live trading variances of 50% or more are possible. When evaluating other signal developers, buyer beware!

How Can I Verify The Performance of Your Autotrading Programs?

InvestiQuant reports the live trading results from its accounts each month. Due to the broker’s “Average Price System” every client receives the same net results for each trade. As such, the simplest way to verify InvestiQuant’s published returns is to ask the broker representative to verify our published figures. (Note: results can vary slightly by broker.)

Do Your Employees Have Access To My Funds?

No. InvestiQuant serves as the 3rd party signal developer and focuses its efforts solely on developing, maintaining and improving advanced algorithmic trading strategies. No iQ employee ever has access or visibility to clients’ funds or trading accounts.

A professionally licensed and registered brokerage firm, with algorithmic trading expertise, supports clients by assisting them with opening and funding their account with another highly regulated entity: a Futures Commissions Merchant. The broker serves as the support representative and liaison between the client and the merchant. The broker also maintains trading desk personnel to oversee and ensure proper algorithmic trade execution of all InvestiQuant signals within each client account. The futures merchant serves as the custodian of the client funds and safeguards them in segregated accounts.

Is There “Key Man” Risk? What Steps Are in Place to Ensure Error-Free Execution?

Many algorithmic investment solutions are entirely dependent upon one or two individuals (typically founders) for their research, coding, and trade operations and most only have 2 or 3 employees. However, redundancy of personnel is crucial for autotrading companies.

What happens if the person who oversees signal generation is on vacation or out sick or leaves the company? What if the data feed breaks or is corrupted? Are there other employees who understands the ins and outs of the algorithmic code and, most importantly, is qualified and trained to make the appropriate decisions and take corrective action if needed?

The InvestiQuant team is a diverse, highly collaborative, cross-functional team consisting of traders, full time software engineers and data analysts. We have the financial wherewithal, personnel and processes in place that ensure critical operations within our company structure will continue in a streamlined manner, no matter the circumstances. Why? Because we risk our money side-by-side with our clients in the exact same trading programs each day.

Are Your Trading Operations and Algorithms Backed-Up With 24/7/365 Power?

All critical InvestiQuant trading signal software and data are safely and securely stored, and backed-up, in cloud-based hosting centers located near the exchange using Amazon Web Services (AWS). Our development team maintains backup power supply in the event of any power outages that sometimes do occur in North Carolina. (Hurricanes are not uncommon.) And, we have systems in place to facilitate and assure that all our trade operations continue, despite inclement weather conditions and situations.

Have additional questions? Reach out to [email protected].

InvestiQuant takes great pride in helping clients invest smarter using institutional quality, automated hedge fund strategies based on advanced machine learning and statistical edges. Whether you are a self-directed investor or a trader, you can be assured that your hard earned capital is being treated with the same care and diligence as our own.