Getting Started with Autotrading: A Guide

Whether you're a hands-on investor or prefer a more set-and-forget approach to your investments, autotrading can be a valuable component of your investment portfolio.

Autotrading Fundamentals

At its core, autotrading is about the efficient pursuit of short-term market opportunities. By utilizing algorithms, predefined instructions for entering and exiting trades can be automated and enabled for trading one’s account. For active traders, this means being able to execute strategies, sometimes several at once, at a speed and consistency impossible to achieve manually. For passive investors, it's about taking advantage of temporary price distortions without having to personally monitor the markets.

But what exactly powers autotrading? It varies greatly by developer, but at InvestiQuant it's a fusion of advanced computational power, sophisticated algorithms, and artificial intelligence (AI) and machine learning (ML) technology that learn and adapt to ever-changing market conditions. Advanced automation and integration applications can allow investors to leverage statistically-based trading programs (designed by professional developers and traders at firms like InvestiQuant) in their own accounts and in a manner that eliminates emotional decision-making and time lags.

Why Autotrading Versus Traditional Diversification?

Time and time again, over the past 40 years, traditional diversification methods have failed to protect investors’ stock-based portfolios. The belief that certain asset classes (e.g. gold, hedge funds, etc.) offer safe harbor during market downturns has been upended as we witness assets that were once uncorrelated moving in lockstep during market downturns, a dilemma known as "crisis correlation" When investors’ holdings in equities (e.g. S&P 500, NASDAQ 100), emerging markets, and even bonds sell off in unison, the traditional concept of diversification is put to the test. This was exemplified by an average 26% decline across various asset classes, including Bitcoin, during the 2022 bear market. Other examples include the 2020 Covid crash, the financial crisis of 2008, and the “dot com meltdown” of 2002.

This shift underscores the need for a different strategy that transcends traditional diversification and performs in a manner that is lowly correlated with stocks. Some autotrading providers, like InvestiQuant, focus on the intraday time frame, which can mitigate the risks and constraints of a buy-and-hold approach. By focusing on intraday trading solutions, investors avoid exposure to the more dangerous overnight markets and can take advantage of the volatility within the trading day itself.

With increased market fluctuations and catalysts, a proactive intraday strategy can thrive, capitalizing on short-term trends and price movements. Although no investment strategy can guarantee profits, and periods of underperformance are inevitable, the evidence points to the potential for such approaches to yield better results than traditional long-term investments—especially during volatile times and periods of market indecision. Rising markets present generous intraday opportunities to profit as well, as index values inflate and daily ranges expand.

The Versatility of Autotrading: Solutions for Every Investor

For Active Investors and Traders considering autotrading, there are many benefits, including:

Confidence: Leverage the expertise, skill, and intellectual property of a team of professional traders (like those at InvestiQuant who rely on the same strategies as their clients every day).

Efficiency: Cut down on the time you spend scouring charts and executing trades. Autotrading can process vast amounts of data and execute trades within milliseconds, and at an error-free rate that is not attainable by humans.

- Diversification: Reliance on a single trading technique or strategy is dangerous. Reduce your stress and your risk by diversifying how your capital is traded. Despite the name “autotrading,” traders maintain full control and visibility of their account and daily activity through programs like those offered by InvestiQuant.

For Passive Investors, autotrading empowers their portfolios with several unique and powerful benefits:

Value-Added, Lowly Correlated Diversification: With the ability to trade long or short on a given day, attractive returns can be generated in both rising and declining markets.

24/7 Visibility and Liquidity: Each investor’s account is enabled in a manner that provides total transparency and control, every trading day of the year.

Cost Savings: Autotrading can be a less expensive alternative to high-fee managed funds, including hedge funds, with the potential for similar or better returns.

Autotrading programs like InvestiQuant offer several entry points depending on the desired level of investment. This creates an attractive alternative to the traditional hedge fund while allowing for the same caliber of investment. Bottomline: Autotrading offers a level of immediacy, control, and individual customization that hedge funds simply cannot match.

Risk Management

Risk is an inherent part of investing, and autotrading is no different. An autotrading provider who does not trade the very same strategies that it offers to the public should be a bright red flag. Furthermore, the solution provider’s commitment to upfront and ongoing transparency is crucial. Publishing actual live trading results of clients’ accounts and, if applicable, realistic, simulated historical performance data enables investors to undertake a comprehensive risk assessment of the autotrading program in consideration. This level of openness is key in empowering investors to make well-informed decisions and minimizing the risk of investing their hard-earned capital in a trading program that has little chance of delivering positive returns.

Ensuring Operational Integrity and Mitigating Risk

Operational risk management is paramount in autotrading. To address these concerns, a trustworthy autotrading service must have a robust operational framework backed by a capable and diverse team, along with strong contingency plans. (Buyer, beware of the one- and two-man developer teams!) The deployment of advanced hosting solutions, such as cloud services, is indicative of a proactive approach to minimizing potential technical and operational disruptions. This ensures continuous and effective execution of autotrading activities, maximizing the integrity and performance of the trading strategies.

By prioritizing such risk management strategies, an autotrading provider can enable a secure and stable solution for investors looking to leverage the advantages of algorithmic trading without compromising on safety and reliability.

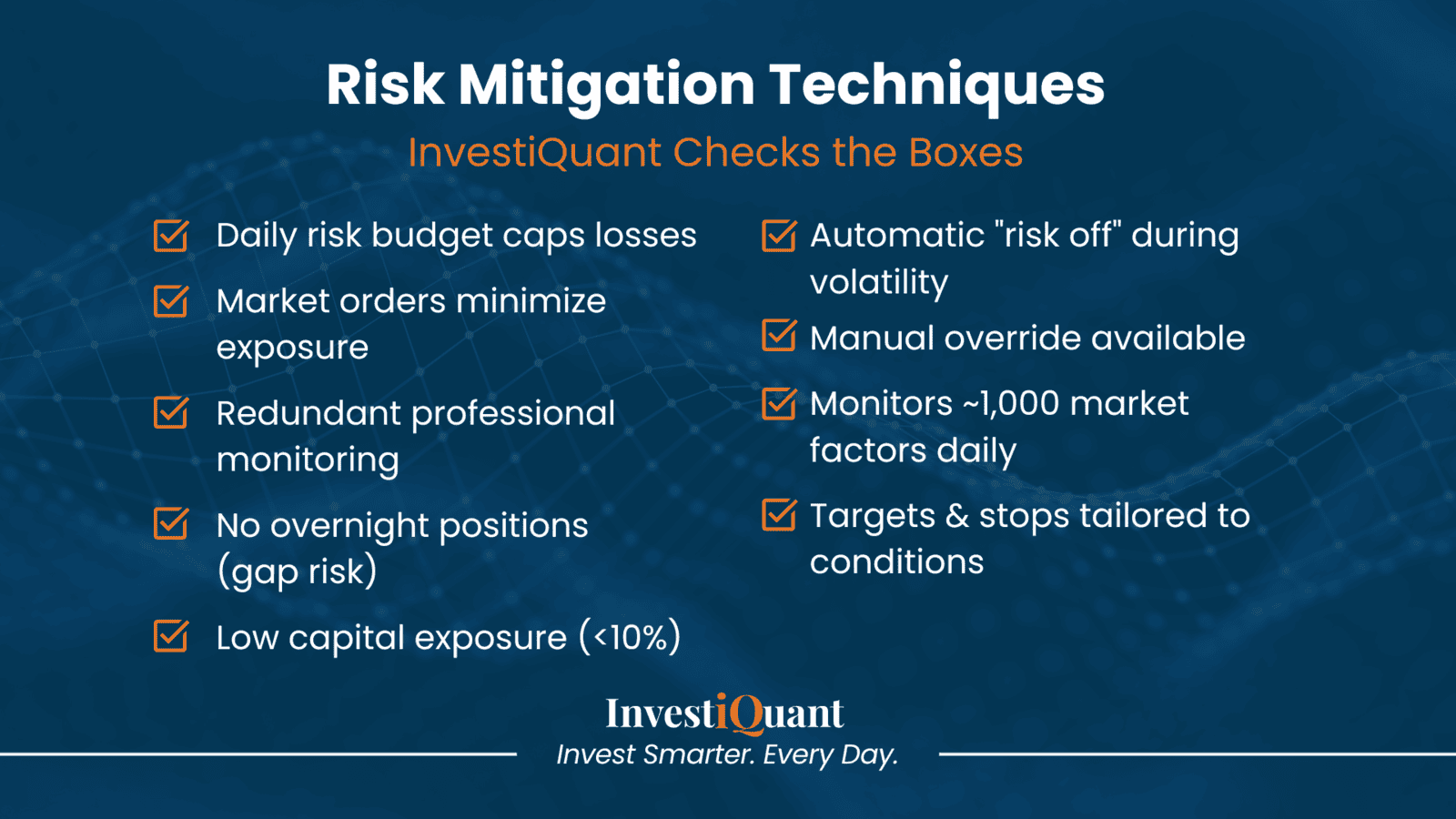

What does effective risk management look like in autotrading programs?

Risk management extends beyond the provider and solution, but also to the trading strategies themselves. Each provider is different, so due diligence is required. InvestiQuant utilizes many important risk-mitigating techniques:

Each automated trading program has a set daily risk budget to cap potential losses and help estimate daily loss exposure.

Market orders are used for exiting positions immediately to minimize market exposure and avoid the risks of unfilled orders.

Redundant monitoring by trading professionals and execution brokers minimizes execution errors and ensures optimal performance.

No overnight positions are held to avoid risks from market gaps due to off-hours events, while keeping capital exposure under 10% compared to traditional stock investing.

An automatic "risk off" feature deactivates trading during extreme market volatility or instability. In addition, manual override is available for use by InvestiQuant or the broker’s trading desk if ever deemed necessary.

Understanding the Autotrading Strategy at Work

To harness the full potential of autotrading, grasping the underlying strategy of the program you're considering is crucial. Trading algorithms are typically grounded in historical market analysis, aiming to identify patterns that signal attractive trading opportunities. The signals generated byInvestiQuant's strategies are designed to capture intraday momentum or mean reversion opportunities by using a diverse range of proprietary indicators and inputs that the company has compiled over the past 15 years. Understanding the robustness of the strategies can provide a layer of comprehension that can be reassuring and informative.

Autotrading programs generally excel in markets where there is enough volatility to create opportunities, yet not so much that it becomes chaotic and unpredictable. They can also be designed to thrive in flat or "sideways" markets where the right strategies can capitalize on small fluctuations for consistent gains. However, it's essential to recognize that no program is infallible.

Key Considerations When Selecting an Autotrading Program

When considering the addition of autotrading to your investment plan, there are several key considerations to weigh to ensure that the program aligns with your financial goals and risk tolerance. Here's a high-level overview of what to keep in mind:

Developer Commitment: Does the developer and members of their team risk their own capital trading the very same program(s)?

Historical Performance: Reviewing the live and simulated track record of an autotrading program can give you insight into its effectiveness and its volatility. Look at how it has performed in different market conditions, and understand that past performance is not always indicative of future results. IMPORTANT: be careful not to depend on hypothetical backtested returns when selecting a program. They are often over-optimized by algo signal providers and will fail to live up to historical expectations.

Risk Management: Critical to any trading strategy is how it manages risk. Investigate whether the autotrading program has predefined risk parameters, uses stop-loss orders, or diversifies across various assets and strategies to mitigate potential losses.

Personal Risk Appetite: Reflect on your comfort level with risk. Autotrading systems can range from conservative to aggressive. It's essential to choose a program that doesn't push you beyond your comfort zone in terms of potential drawdowns or volatile market movements.

Solution's Risk Management: Delve into the specific risk management tactics the autotrading solution employs. Does it adapt to changing market volatility? How does it react to abnormal market conditions? Knowing this will help you understand the resilience of the strategy.

Required Account Minimum: Consider the financial commitment. Autotrading solutions often have a required account minimum, which can be a significant factor in your decision, especially if you're starting with a smaller investment capital.

License Fee: Consider the cost of the annual fees versus the historical annual gains (not the funding level, as this can be greatly misleading for programs that trade futures and can generate outsized returns like those offered by InvestiQuant).

By carefully examining these elements, you can make a more informed decision about whether autotrading is a suitable tool for your investment strategy and how to select the program that best fits your needs.

The InvestiQuant Difference

InvestiQuant is a leading provider and innovator of advanced autotrading solutions. We’ve been serving clients around the world since 2008 and specialize in intraday programs that trade tax-advantaged futures markets. Unlike other algorithmic trading and AI “bot” solutions, you're not tethered to your computer screen, monitoring every tick of the market. Nor do you need to worry and bother with installing and managing any software on your computer. Instead, our clients are 100% free to go about their day and leave the responsibility of executing, monitoring, and managing trades to us and our specialized brokers.

Once you've set up your account, you can manage your investment level, tuning your exposure to align with your financial goals and risk appetite. InvestiQuant takes care of the rest, executing trades based on strategies that are not just theories but are statistically backed, painstakingly researched, and meticulously developed. And, unlike many, if not most autotrading providers, the InvestiQuant team trades our own capital alongside our clients and in a manner where everyone earns the same trade results at each broker. We win together, and we lose together.

While there are other autotrading solutions available, our innovative programs distinguish themselves through our adaptive, data-centric approach. Our robust, cloud-based infrastructure empowers multiple, scalable solutions that can accommodates the needs of a diverse investor base, from the most conservative to the most aggressive, from large family offices to individual retail investors with less capital.

Where our approach to autotrading shines is in its depth of strategy research and development. Most of our programs consist of a comprehensive suite of strategies, each with a quantifiable track record and based on a wide range of diverse inputs and edges.

In comparison to other providers, InvestiQuant’s mix of operational flexibility, strategic variety, and user-friendly solutions makes it a compelling choice for both the seasoned trader and the savvy investor looking for quality, value-added diversification. Developed by two West Point graduates with decades of combined retail and professional trading experience, InvestiQuant’s strategies have stood the test of time, with many having been traded since prior to the 2008 recession.

Conclusion

Whether your focus is the protection of your wealth, capital appreciation, or both, InvestiQuant's autotrading programs are designed to help you achieve your financial goals. By leveraging our sophisticated, algorithmic trading solution, you benefit from a system that's continuously at work for you, adapting to ever-changing market conditions and pursuing only the most attractive trading opportunities every day of the year.

Curiosity piqued? Request more information today and discover how InvestiQuant can help you invest smarter - every day.