iQ Autotrading:

AI-Driven Investment Solutions for Modern Investors

InvestiQuant delivers automated, hedge fund-quality strategies powered by a decade of AI and machine-learning innovation. Designed for investors of all sizes, iQ Autotrading offers a fully automated approach to trading that avoids or minimizes overnight market exposure. We provide transparency and control through direct integration with your brokerage account, allowing you to stay informed and in control at all times.

Unlike traditional hedge funds, there are no lock-ups, just 24/7 visibility, access, and control. Your account trades alongside our founders and hundreds of investors, giving you a fully automated, hands-free approach to capturing high-quality market opportunities with confidence.

Diversification

Strong Returns

Control & Transparency

Your Account

iQ Strategies

Professional Oversight

Arming Investors’ Portfolios with Fully Automated,

Self-Learning Hedge Fund Strategies

InvestiQuant offers automated hedge fund strategies via multiple autotrading programs for investors of all sizes. Unlike most hedge funds and CTA programs, our hedging and growth strategies only trade stock indices like (the S&P 500 and the Nasdaq 100) and hold positions intraday, using futures contracts during the regular NYSE stock market hours. There is no overnight risk or exposure. Despite their short duration, and unlike day trading and swing trading strategies, iQ’s hedge fund strategies receive beneficial tax treatment (U.S.).

The iQ autotrading suite employs multiple algorithmic strategies tailored to exploit just about any market environment. Leveraging the power of a massive proprietary database, predictive analytics and decades of live trading expertise, InvestiQuant’s adaptive algorithms identify and execute trades based on short-term market opportunities in the S&P 500 and related index indices like the Nasdaq 100.

To adapt to the ever-changing markets, InvestiQuant’s alternative investment and hedge fund strategies utilize iQ’s advanced AI algorithmic engine as a major signal input. Unlike many firms which offer strategies based on artificial intelligence, InvestiQuant has been building, testing and trading AI-based hedge fund strategies for over a decade (since 2013). The Director of Duke University’s Center for Quantitative Modeling serves on the company’s Board of Directors.

| Our Solutions | Our Company |

|

|

iQ Autotrading Strengthens Portfolios and Solves Key Challenges

As a passive, self-directed investor, the challenges in managing and growing your wealth using today’s volatile markets are significant. iQ Autotrading addresses these challenges head-on by providing an innovative hedge fund alternative with many benefits:

1. Stronger portfolio diversification and protection

iQ strategies trade long or short and most avoid overnight risks, acting as a lowly correlated asset class within your portfolio, enhancing diversification and reducing exposure when you need it most.

2. Performance in rising and declining markets

Self-learning and highly adaptive iQ strategies are built to perform regardless of market direction, eliminating the need to time the market.

3. Hedge Fund-quality protection across your broader investments

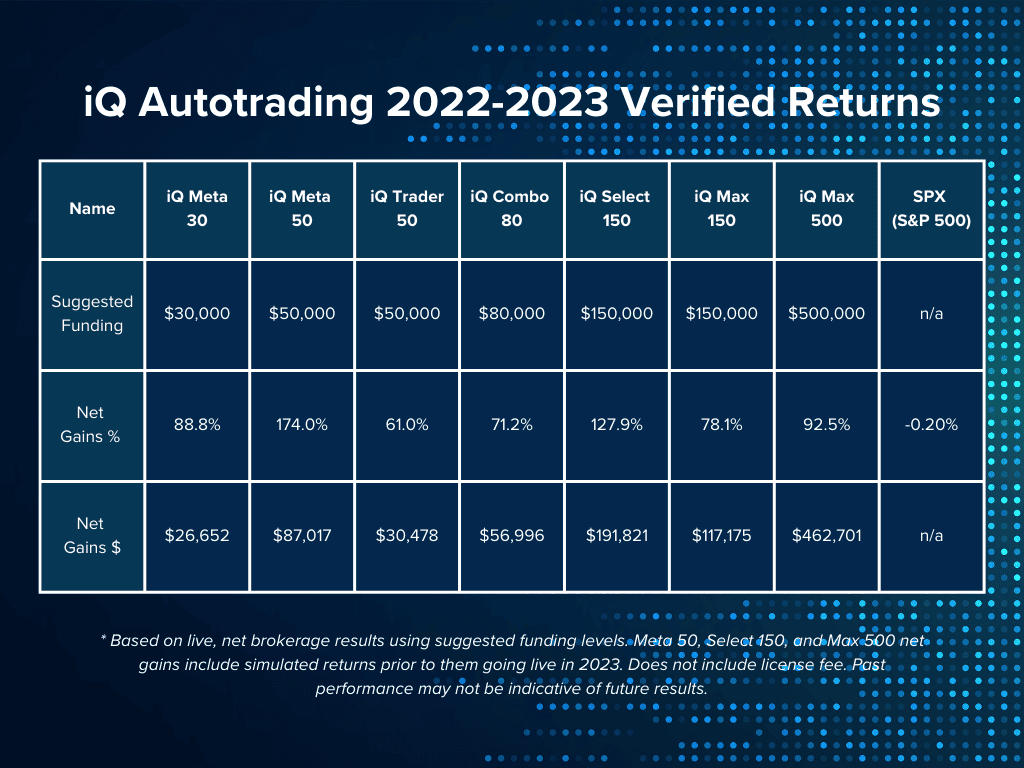

Unlike most hedge funds, mutual funds, ETFs and other stock, bond and commodity-driven strategies, iQ Autotrading has a history of providing true, hedge fund-quality protection and can help reduce and even eliminate portfolio losses during bear markets and periods of “crisis correlation” (e.g. 2000-2003, 2008-2010, 2022). See for yourself and check out our 2022 performance.

4. Turn volatility into opportunity

Our algorithms are specifically designed to capitalize on volatility, transforming short-term market swings into profitable opportunities.

5. More consistent returns over time

By systematically managing exposure and trading both directions, iQ Autotrading can help smooth returns and improve long-term portfolio stability.

6. Flexibility, control, and tax efficiency

Futures contracts provide built-in leverage, allowing for lower funding requirements and customizable strategies. Plus, they receive favorable tax treatment under U.S. code (60% long-term, 40% short-term).

iQ Autotrading Helps Investors Of All Types And Sizes Diversify

We understand that you've worked hard to accumulate your wealth, and need to diversify in a way that will better protect and grow it no matter what the future brings. You deserve a solution that you can trust to handle volatility and deliver returns in both rising and declining markets. InvestiQuant has served investors in over 20 countries and they all acquired their wealth differently. iQ clients include:

Small business owners

Doctors, dentists, lawyers, airline pilots and business executives

Real estate investors

Stocks, ETFs and bonds investors

Forex, commodity and hedge fund investors

Bitcoin and crypto investors

Family offices, accredited, QEP and other high net worth investors

No matter how you built your nest egg, you are in the right place. iQ Autotrading provides powerful, valued-added diversification that can improve the performance and stability of your investment portfolio using powerful AI-driven strategies.

The iQ Story:Empowering Investors With Hedge Fund Strategies That Work

The bursting of the 2000-2002 internet “dot com” bubble bursting, changed our founders’ lives forever (public software company executives) and led them to pursue a way to make market volatility work for—instead of against—their portfolios. And, in a way that would avoid the shortcomings and limitations of most hedge funds. Ultimately, their vision and persistence led to the creation of iQ's cutting-edge automated hedge fund strategies and systematic trading programs.

iQ Autotrading: The Benefits of A Hedge Fund

—Without The Downside

Diversification

46% Avg. 2022 Return

Control & Transparency

How Does iQ Autotrading Work?

You stay in control. Activate or deactivate your account at any time

By enabling iQ Autotrading, your broker gains access to our trusted investment strategies will be enabled to execute trades in your account with the expertise and oversight of one of our specialized brokers. This hands-free solution can work for you and your portfolio in a matter of days. This seamless integration allows you to benefit from the full potential of our automated trading systems.

Join us as we embrace the future of investing and uncover the unparalleled power of fully automated algorithmic trading tailored using adaptive hedge fund strategies for sophisticated investors.