iQ Solutions: Diversify, Protect, and Grow Your Wealth with iQ's Autotrading Programs

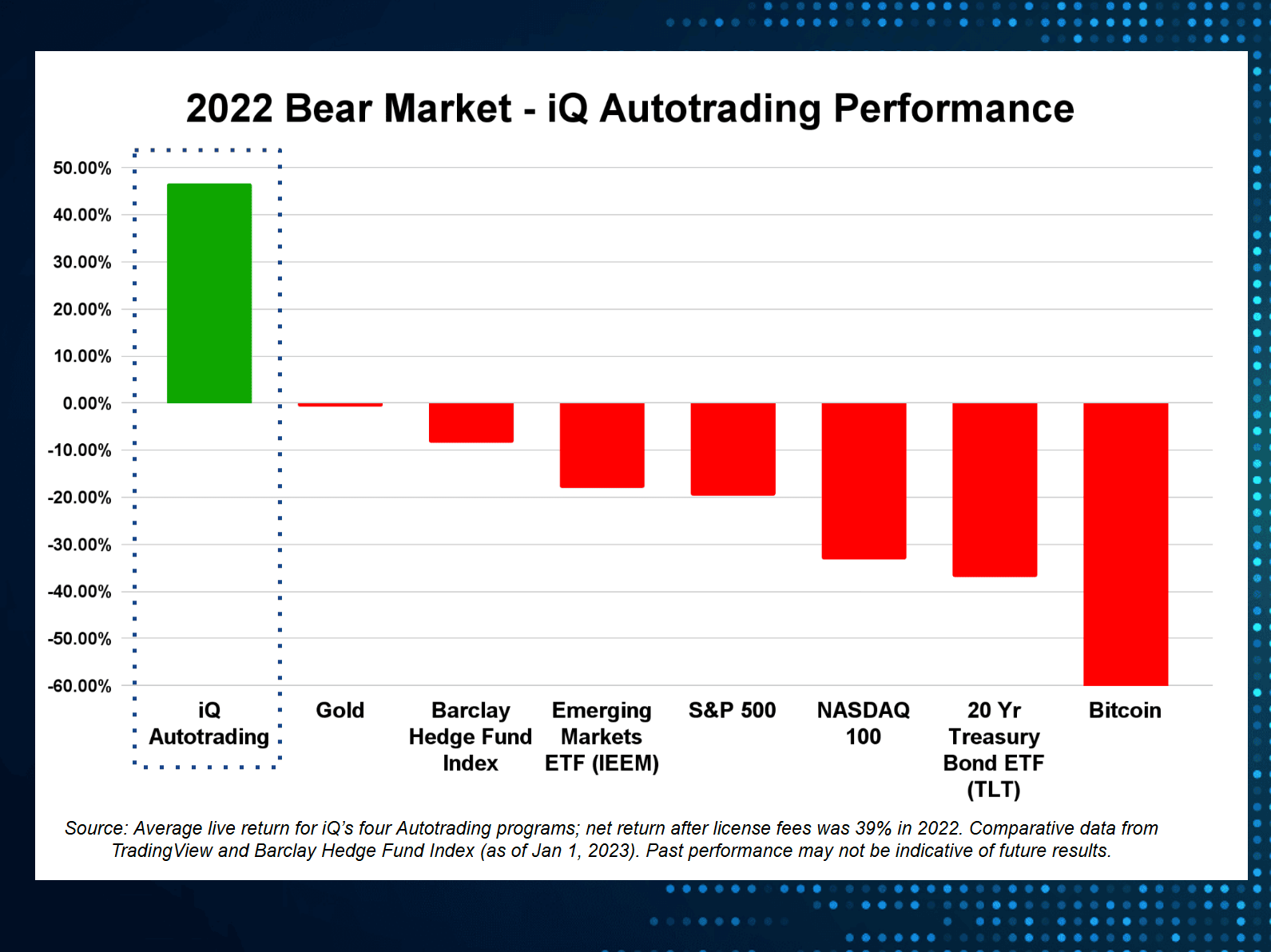

Since 2008, InvestiQuant's commitment to innovation and algorithmic trading has made us a trusted alternative investment for traders and investors alike. Our autotrading programs are designed for volatile markets and a wide range of market conditions, including bull markets, bear markets, and non-trending markets.

InvestiQuant offers a wide array of automated trading programs. Each is designed for different funding levels and risk tolerances with the goal of generating strong returns, with controlled risk, regardless of the direction of the broader markets.

iQ Autotrading Brokers Provide Clients with Convenience, Flexibility, & Safety

Why InvestiQuant’s Automated Trading Strategies Perform Better Than Most Hedge Funds, CTAs, and System Developers

The following are the actual trading results (not hypothetical) realized in live trading of client accounts in 2022-2023:

The iQ autotrading suite employs multiple algorithmic strategies tailored to exploit just about any market environment. Leveraging the power of a massive proprietary database, predictive analytics, and decades of live trading expertise, InvestiQuant’s adaptive algorithms identify and execute trades based on short-term market opportunities in the global futures markets, including the S&P 500 and Nasdaq 100.

To adapt to the ever-changing markets, InvestiQuant’s alternative investment and hedge fund strategies utilize iQ’s advanced AI algorithmic engine as a major signal input.

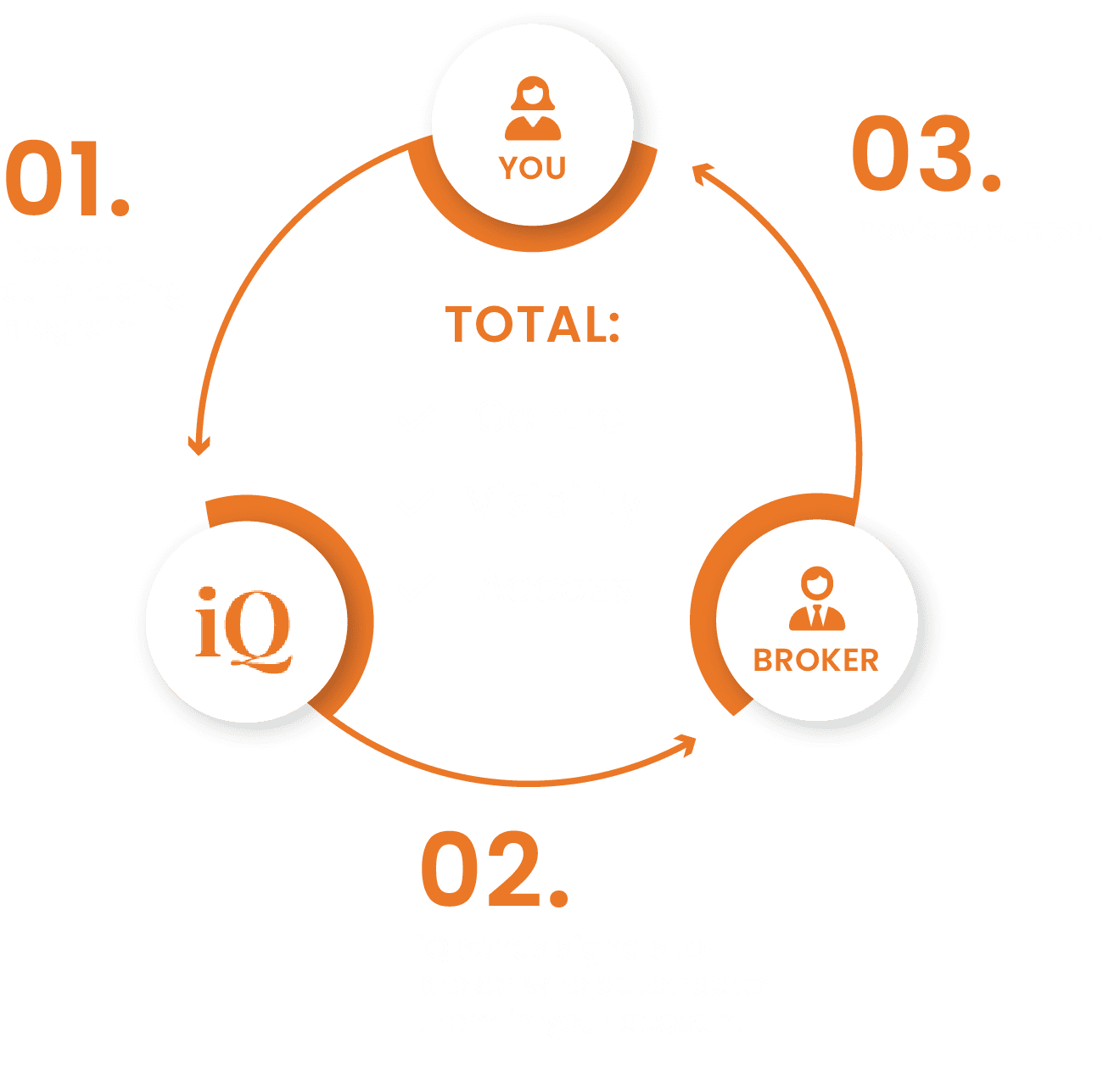

Turnkey Automated Trading With Professional Oversight

and YOU In Control

It takes more than quality trading strategies to create a great solution. Lightning-fast execution of future signals, using sophisticated, fully automated algorithms, enabled across hundreds of client accounts simultaneously, requires real-time, professional oversight and expertise. The average discount broker won’t cut it. And, it requires a merchant where you can rest easy knowing that your investment is safe-guarded, 24x7, 365 days a year.

InvestiQuant only works with select, specialized execution brokers who are experts in algorithmic futures trading, as well as providing 1-on-1 client support. Their job is to ensure our quantitative trading signals are flawlessly executed across all clients’ accounts and that everyone gets the same results every day.

The Power of AI Autotrading: Real-Time Market Analysis and Pattern Recognition

AI autotrading with advanced algorithms is a game-changer. But, buyer beware: with a little time and effort, just about any software engineer can create a trading strategy based on artificial intelligence. Few will work.

Why? Because the power is not in the AI software (which is rapidly being commoditized), but in the <DATA> that feeds it.

Over the past 20 years, the iQ team has built nearly 1,000 proprietary intraday and overnight market factors to serve as inputs to iQ’s sophisticated, 2nd generation AI-driven strategies. We are pioneers in the development and application of adaptive trading algorithms based on AI and advanced machine-learning techniques to maximize autotrading returns and reduce risks. We created our first-generation machine-learning strategies in 2012-14, refined them with the help of Duke University's Center for Quantitative Modeling in 2015-2016 (the Director is an investor in the company and advises the iQ Board), and created our 2nd generation AI technology in 2021. Our AI autotrading results speak for themselves.

Discover the iQ Automated Trading Difference For Yourself

InvestiQuant's automated trading programs provide a comprehensive, turnkey alternative investment solution for investors looking to diversify, protect, and grow their wealth. With the added convenience, flexibility, and safety offered by iQ Autotrading Programs, you can confidently entrust your investment capital to InvestiQuant's "next generation" solutions.