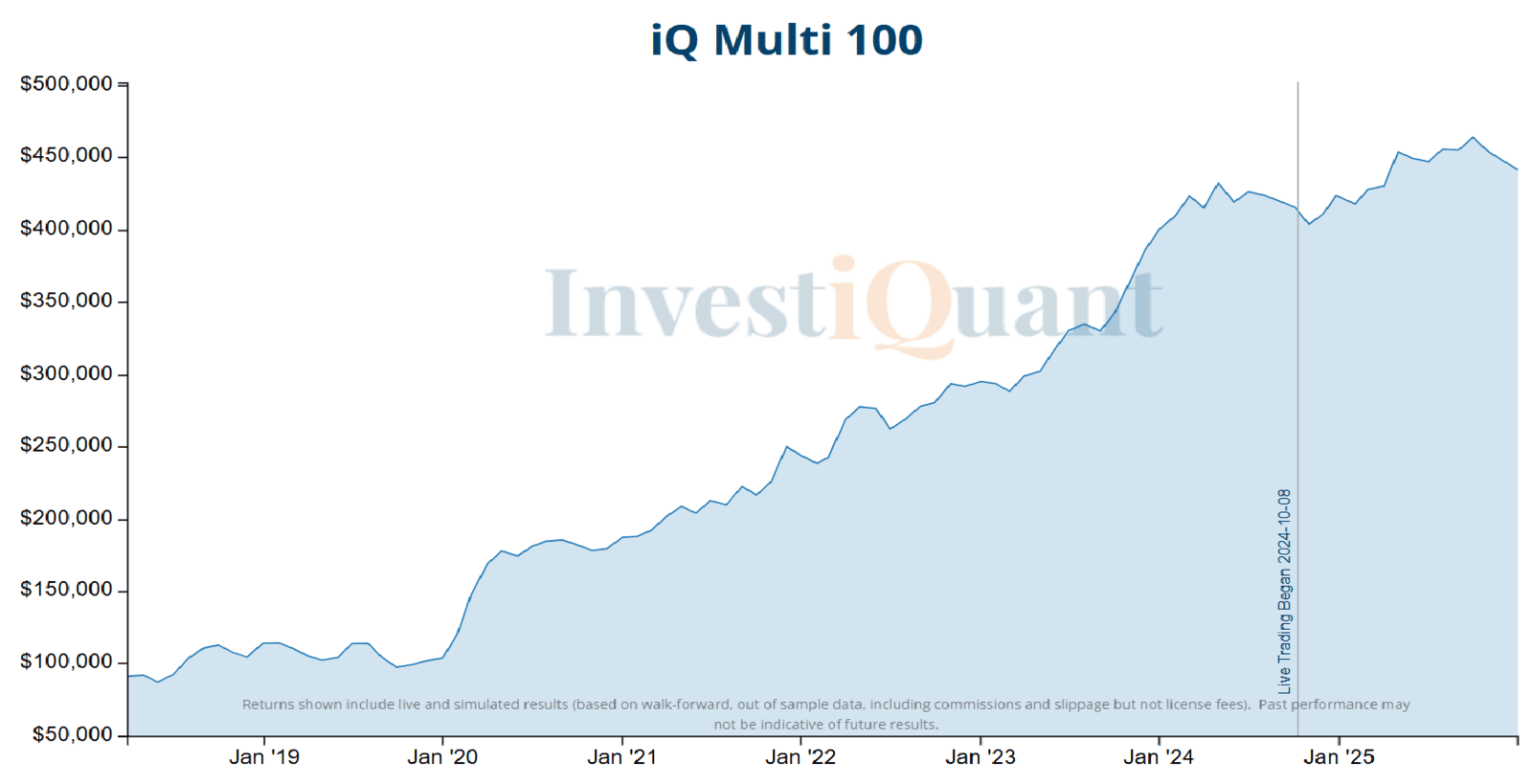

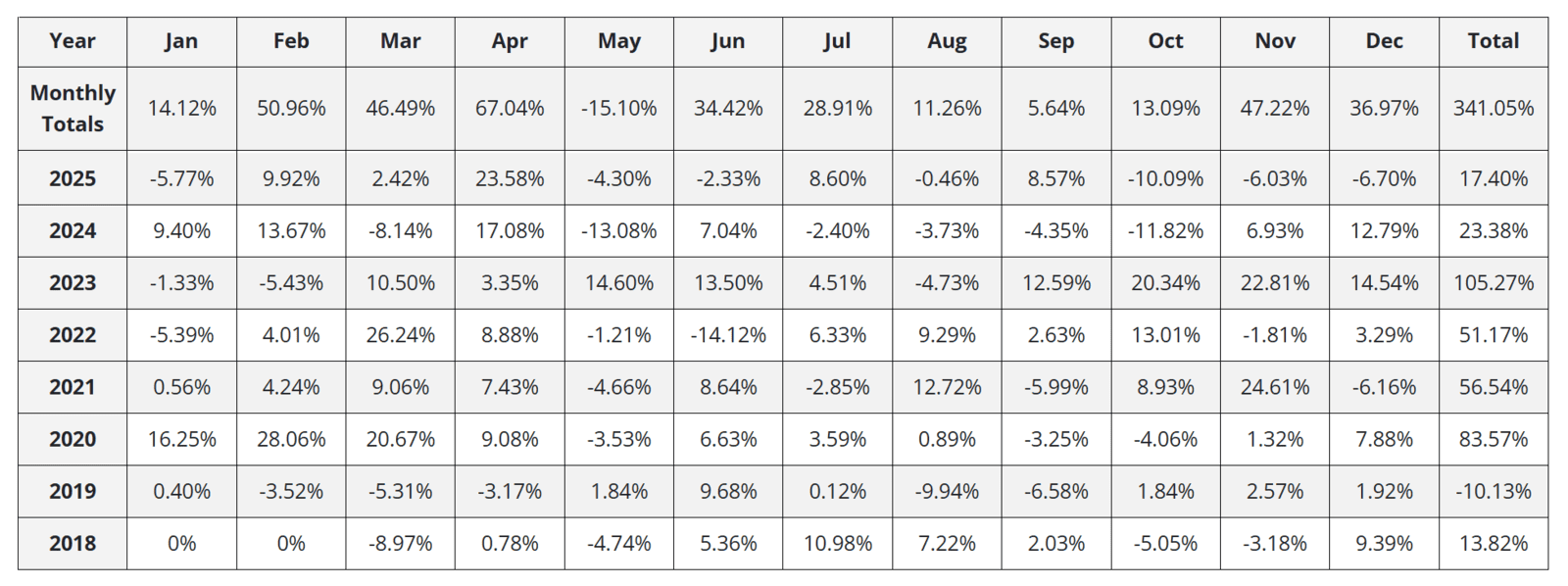

We’re excited to introduce the iQ Multi 100—an advanced addition to our family of adaptive autotrading programs. The Multi 100 targets outsized opportunities across ~10 low-correlated futures markets using a blend of intraday and multi-day strategies that can trade both long and short. Trading around the clock, it’s built to capture the best opportunities, whenever and wherever they arise, while complementing traditional stock-based portfolios (as well as our intraday-only programs). If your portfolio needs unique, value-added diversification, then check out the Multi-100.

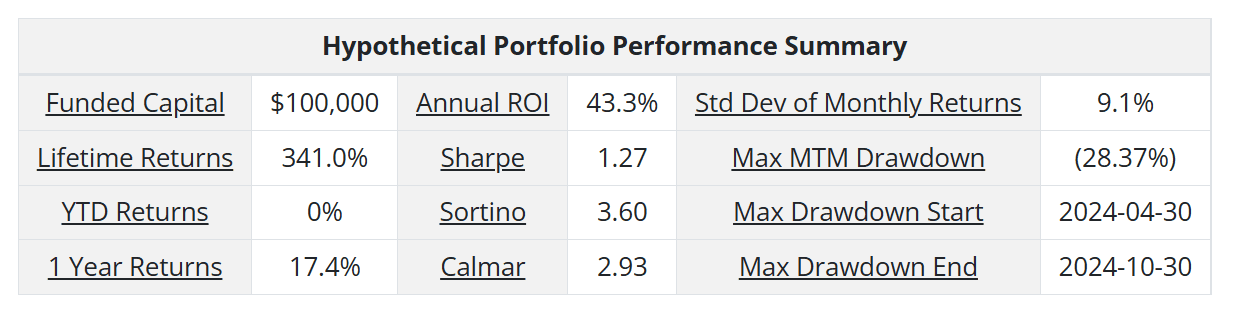

Suggested Funding: $100,000 (lower if approved by broker)

Objective: Capture aggressive returns that are lowly correlated with equities and iQ intraday programs

Strategies: This program employs a diverse portfolio of strategies across ~10 lowly correlated futures markets. It is designed to identify and capitalize on outsized opportunities. Most strategies will execute around the clock and are capable of holding positions for multiple days to capture extended moves.

Co-developed with a trusted 3rd party who has traded the strategies for years with compelling verified results.

Max Trade Risk: Up to $4,000 / trade (4%)

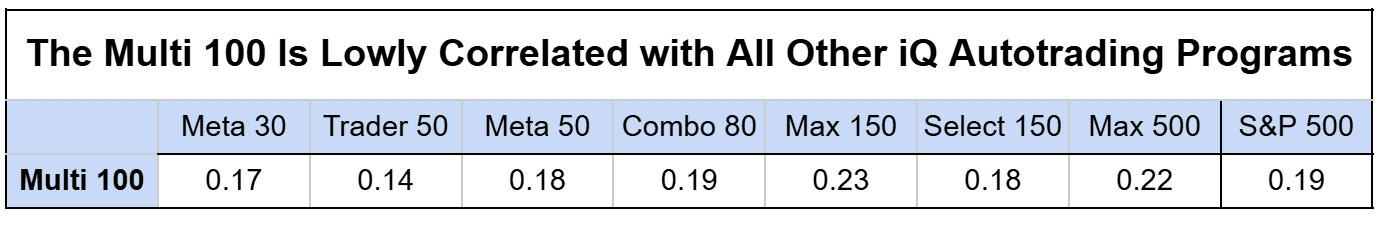

Correlation: Lowly correlated with equities or other iQ programs

Frequently Asked Questions: Multi 100

What’s the funding level?

We suggest using $100,000, but you may start with less with broker approval.

What type of strategies does it use?

It uses a mix of intraday and multi-day trend following, momentum and mean reversion strategies to trade both long and short, whenever the best opportunities are present.

What markets does it trade?

In live trading it has held positions in currency and index futures, metals, energy, agricultural commodities and more. The Multi-100 could trade additional markets in the future as trends and opportunities present themselves.

How often does it trade?

~200/yr, but can vary a lot year-to-year depending on market conditions.

What can you tell me about the part of the program developed by iQ?

It uses our next generation / latest machine-learning (ML) technology and trades intraday only. It trades the Nasdaq futures (NQ), but could day trade other markets in the future. Its maximum daily risk budget is $4k.

Are the Multi 100 strategies traded in any other iQ programs?

The intraday portion of the Multi 100 can also trade in the Max 500 if the signal is generated on a day in which there is risk budget available.

What’s the annual license fee?

The Multi 100 is available for $8,700.

Did You Know?

The Multi 100 is InvestiQuant’s least correlated program relative to our other intraday strategies—and it also shows minimal correlation with the S&P 500 (0.19 correlation).