Let's Talk Strategies

Investing Basics - Short Selling

When people find out that I am a professional trader, one of the common questions they ask is how do the pros make money when the market goes down?

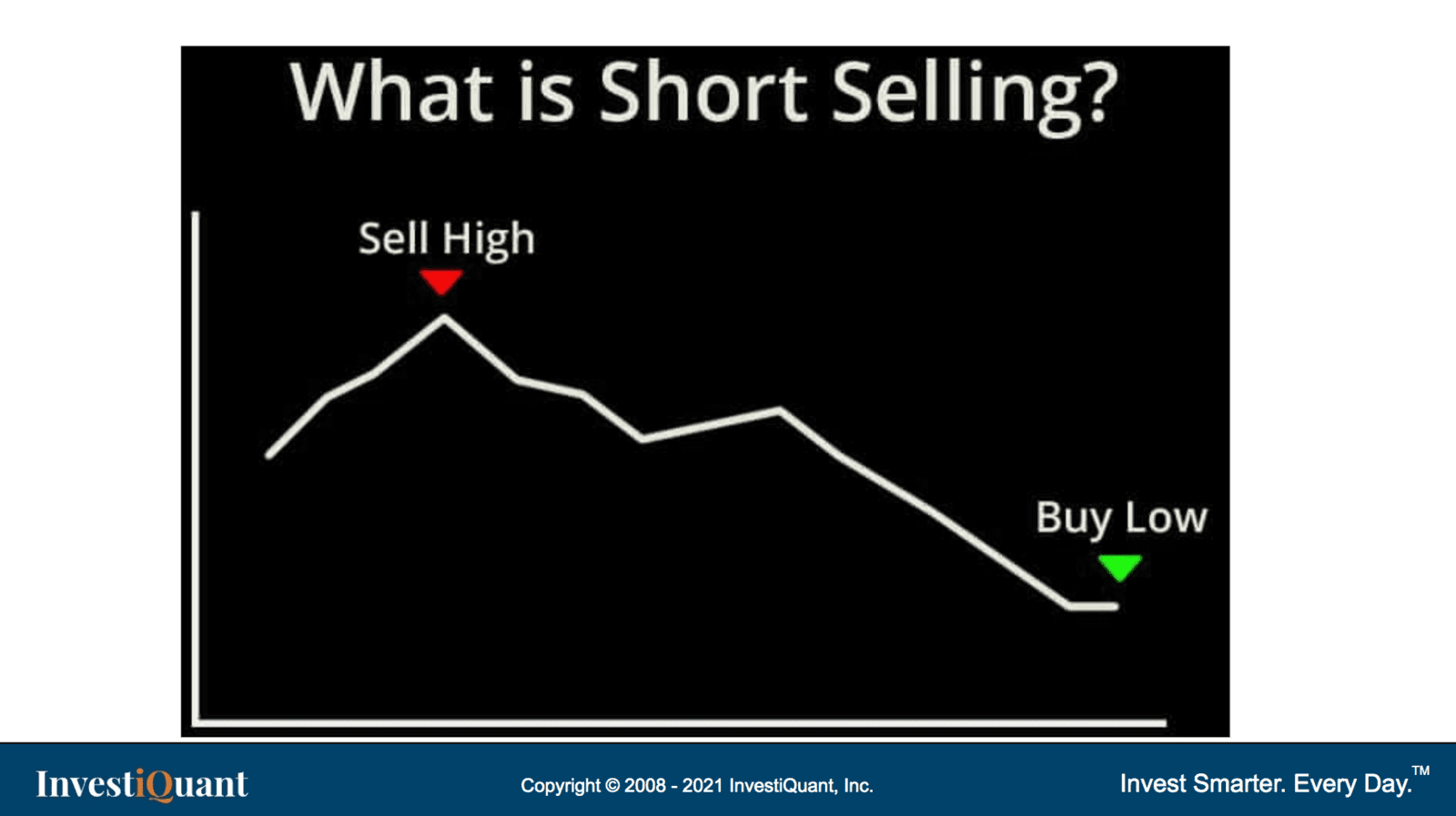

There are many techniques, but the most basic is simply short selling (aka “shorting”). Short selling is when you sell the instrument (stock/futures/etf) first, then buy it back at a later date. (sounds crazy, but it’s a common practice that is allowed by most brokers).

Here is an example: Stock XYZ is trading at $100 and you think it is likely to go down to $90. You could short (sell) the stock at $100 and if/when it drops to $90, you buy the shares that you shorted back and profit the difference between $100 - $90 ($10). However, if the stock moved higher you would lose money (you would lose however much higher it went above the price that you sold it).

Shorting stocks is generally seen as riskier than buying stocks and we don’t generally recommend retail traders and investors try it. That is because stocks can only go down to $0, but they can continue to move higher indefinitely. So your long trades can “only” lose 100% of the invested amount, but shorting a stock could potentially lose more than 100%. That being said, with proper risk management shorting can be very profitable when the odds are on your side.

If you have questions or comments, please use the spaces below.