Let's Talk Strategies

Investing Basics - Stop Loss Orders

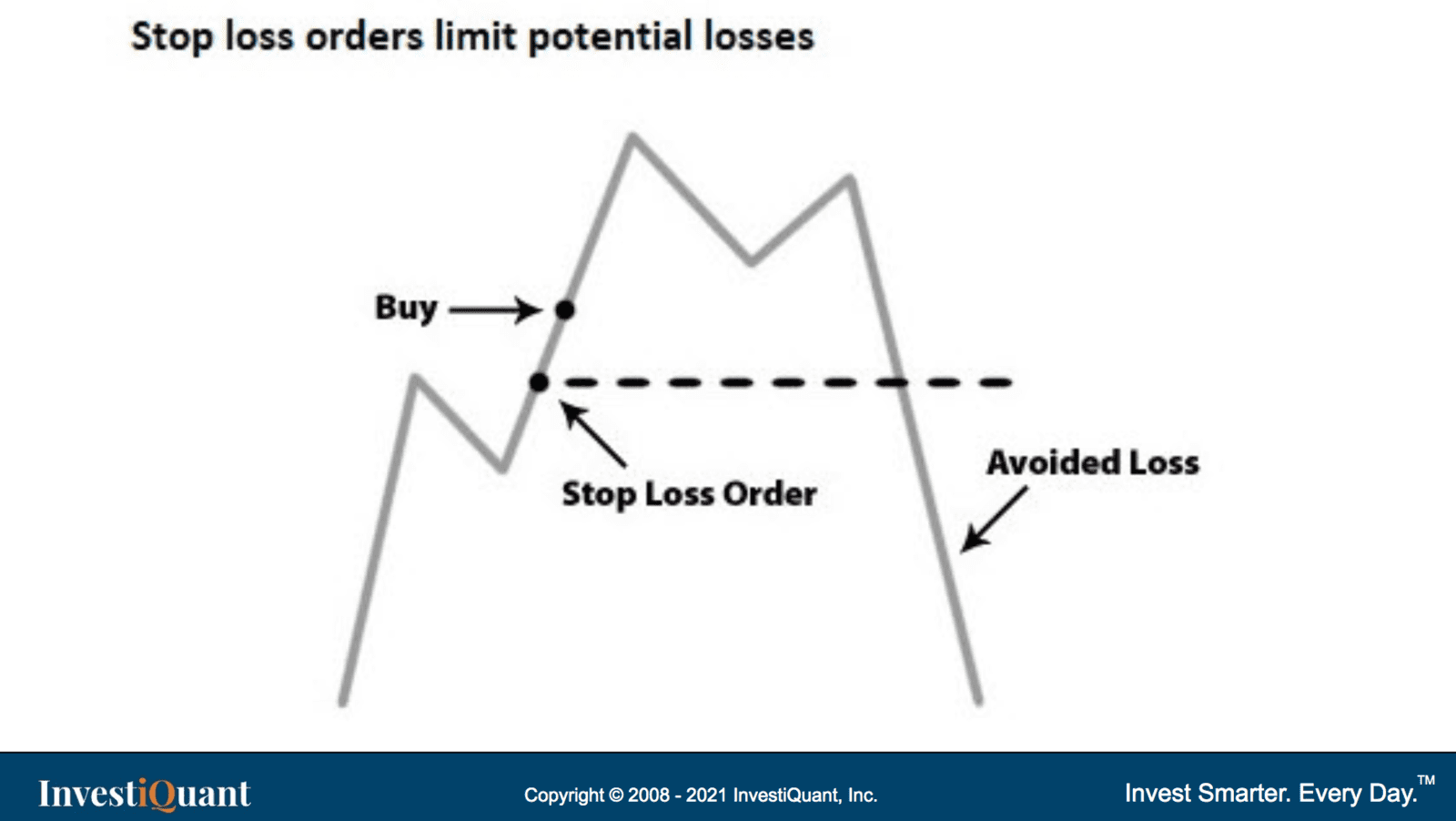

To be profitable in your trading and investing, it is crucial that you know when you are wrong. A stop loss order is a risk management tool intended to get you out of a trade that is not working.

Here is an example of a stop loss:

An investor has a thesis that stock XYZ (which is currently trading at $100) is likely to go to up to somewhere between $125 -$150. But, if the stock sells off below $90, he believes his thesis is no longer valid.

The investor buys the stock at $100, then places a stop market order at $89.99. The stop market order will ensure that the stock is sold for a loss if stock XYZ trades below $90. If the stock doesn’t trade below $90, the order will never be triggered and the investor can exit at his desired target area as his thesis plays out.

Nobody likes to lock in a loss, but having a plan to do so when your ideas do not work, can save you from a potential disaster.

Are you using stop losses on your investments?

If you have questions or comments, please use the spaces below.