Let's Talk Strategies

Investing Basics - Trading Using Margin

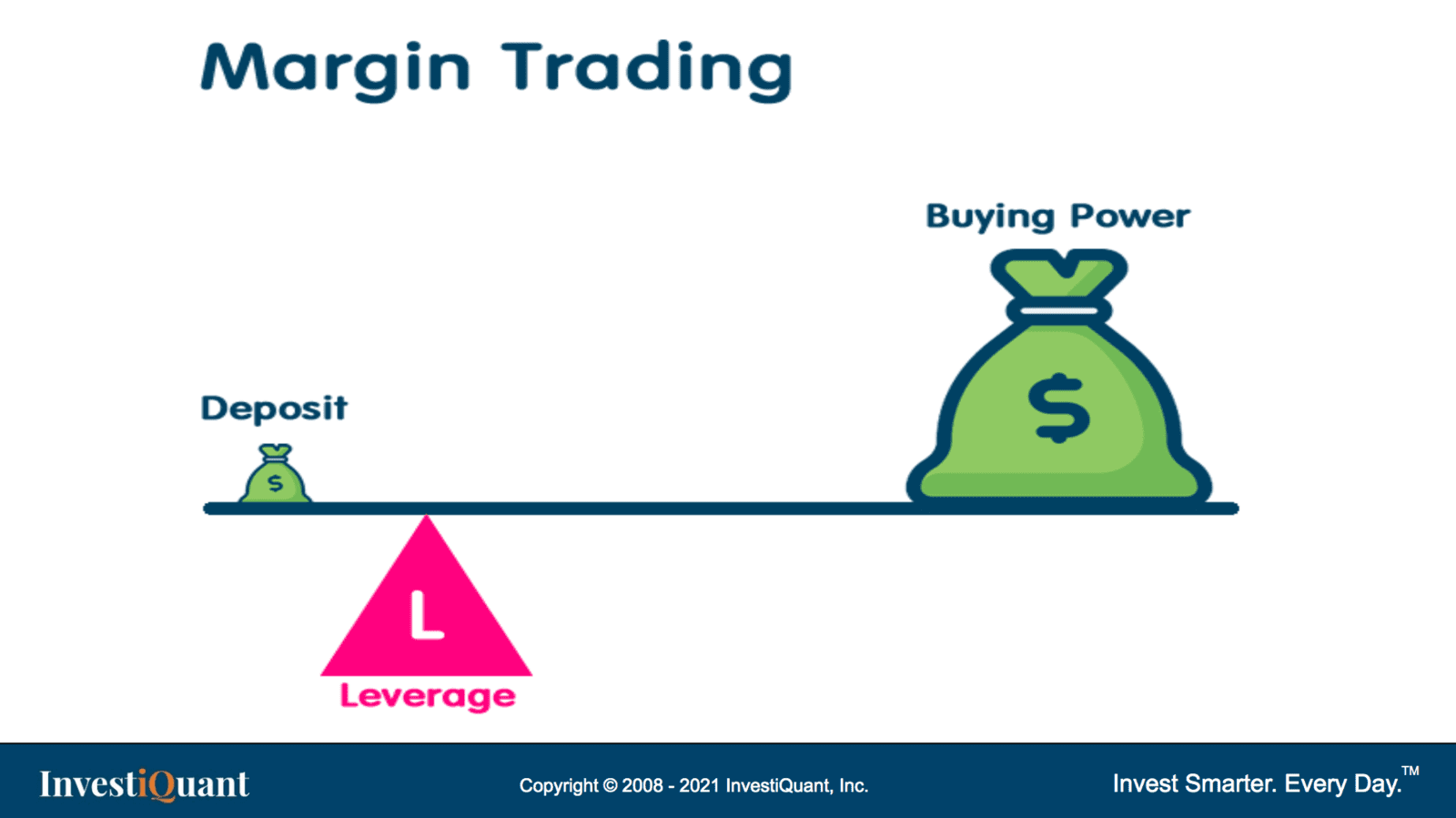

“Margin” is money provided to you by your broker so that you may buy a stock or make a trade. Active investing using margin has become increasingly popular of late with the influx of new investors who are trading meme stocks.

When you use margin to buy a stock, you are literally borrowing capital from your brokerage to buy a position. To do this, you need to have pre-approval from your broker to make it a margin account.

Here is a hypothetical example of a margin trade:

An investor wants to buy 100 shares of AAPL at $150, however, their account only has $7,500 available and the purchase requires $15,000.

The investor buys the 100 shares of AAPL using all their $7,500 in cash and uses margin to cover the extra $7,500.

The next day AAPL moves up to $165 and the investor sells the shares. The profit on the trade is $15 per share x 100 shares = $1,500. This is a 10% profit on the position, however, the investor only used $7,500 of his own capital so his return on investment was 20%.

When done properly, using margin can help accelerate your account growth and realize larger gains on your capital. But, it also means the losses will be larger as well.

Do you use margin to trade?

If you have questions or comments, please use the spaces below.