Let's Talk Strategies

Investing Basics - Limit Orders

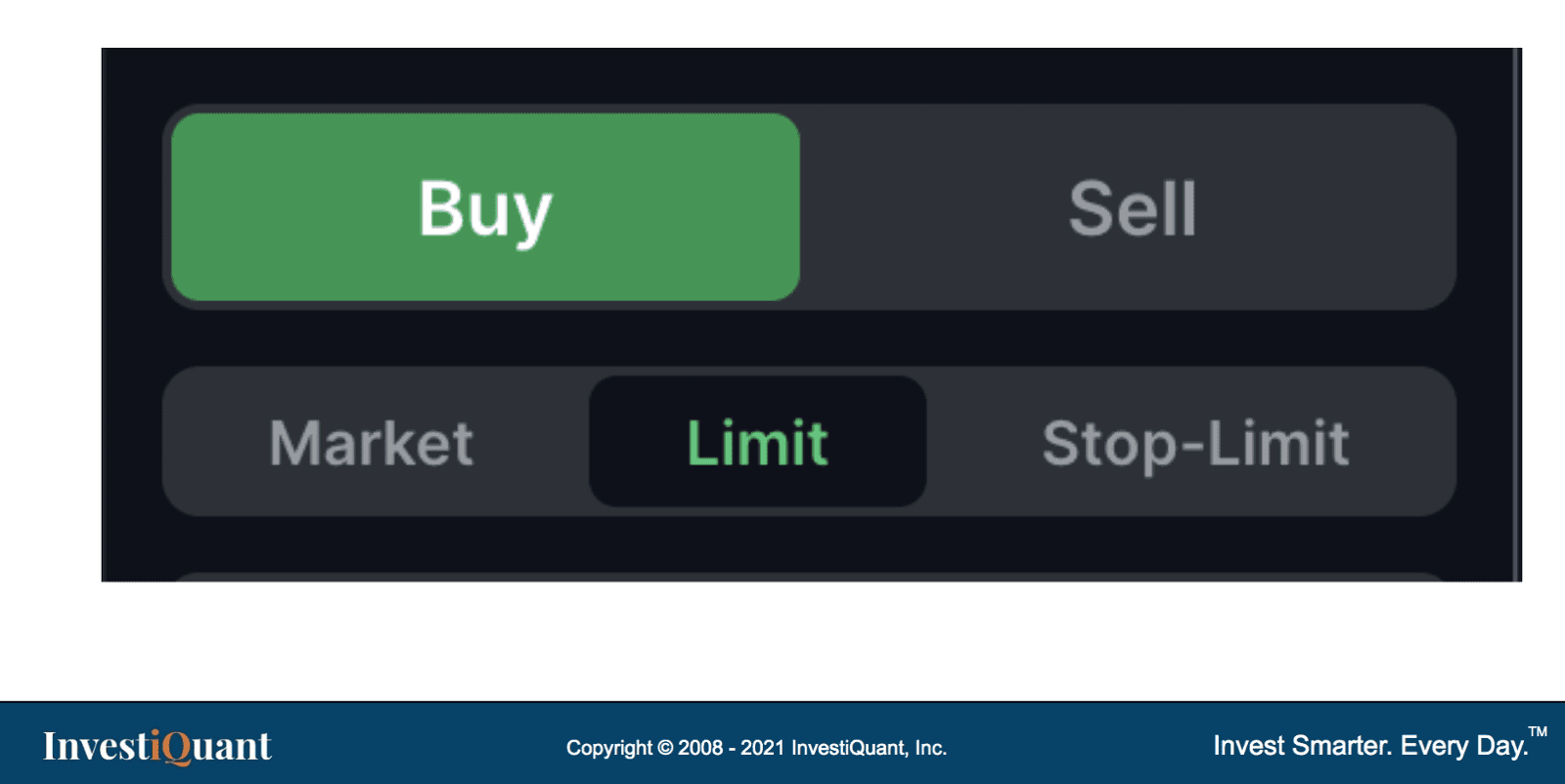

It is important that you understand the types of orders you use when you are trading and investing.

A “limit order” is a popular order type that has the distinct advantage of guaranteeing you get the price you want when you execute the trade. When you place a limit order you are instructing your broker to execute your trade at a predetermined price, or at a price that is better.

Here is an example: let’s say stock XYZ is trading at $100 and you want to buy it, but you only want to pay $95 for it. You can enter a limit order to buy the stock at $95.00 and if the stock trades down to $95 or lower you should get filled. There are cases though where the stock could trade to your exact limit price ($95.00) and you not get filled. That’s because there is an order queue at each price and the trades fill based on who entered their order first. If someone has orders in front of yours, and there isn’t enough volume trading at that price, you may not get filled or may only get a partial fill. When using a limit order, you need price to trade through your limit order level to ensure you are filled.

When taking profits, I use limit orders most often. Are you using them?

If you have questions or comments, please use the spaces below.