In this month’s update…

January Performance

Another Reason To Be Optimistic About Autotrading in 2025

Why Now? Two (More) Reasons…

Did You Know?

Performance Review

When volatility occurs in the markets it’s often because selling pressure exceeds buying pressure and prices will decline. However, sometimes the selling pressure will be countered by even greater buying pressure and that was the case in January as the S&P 500 finished up +2.7%. When this happens (prices and volatility both rise) it can mean a number of things like investor uncertainty or simply a cyclical rotation.

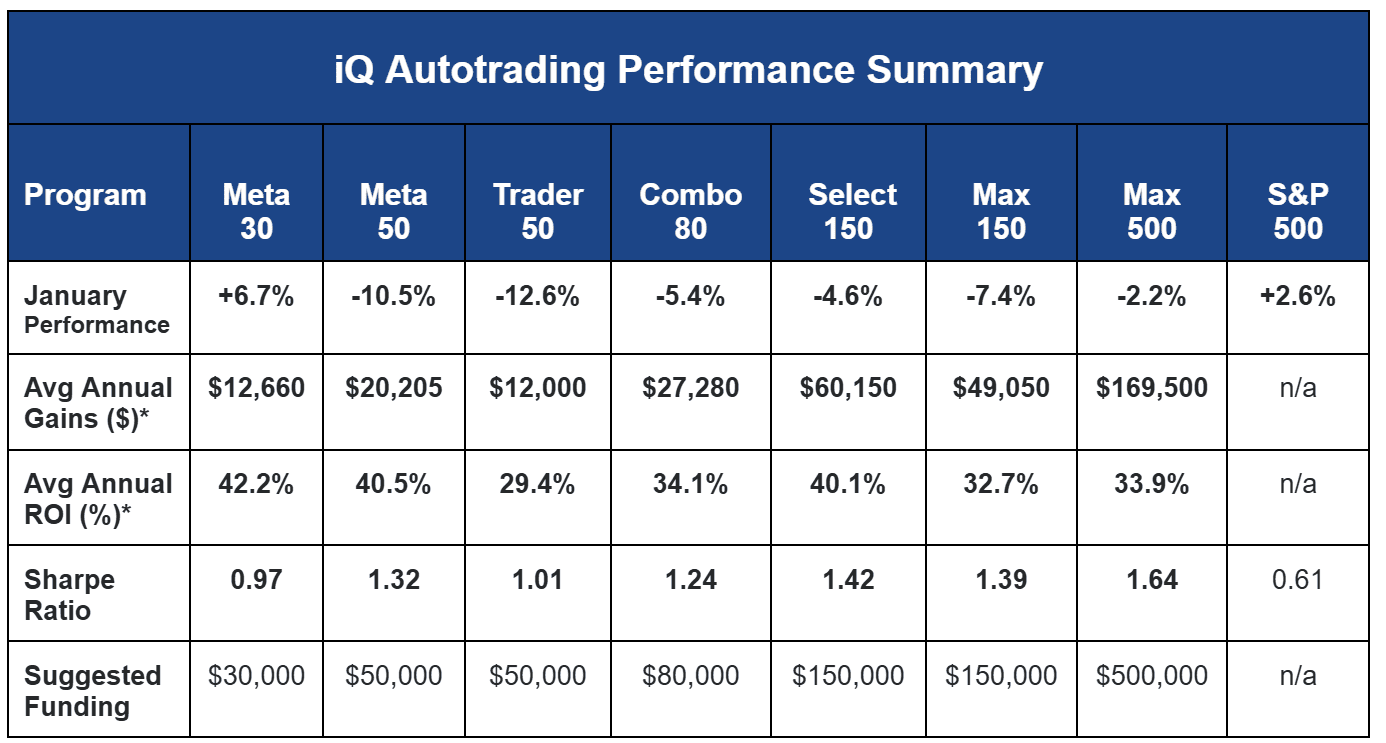

Regardless of the cause, such directionless periods can result in choppy autotrading returns like we experienced in January with most of the iQ programs finishing down. Interestingly, Meta 30, our biggest laggard in 2024, was the shining star of the month as it generated a nice +6.7% gain.

* Returns based on live and simulated results since 2018, using suggested funding. Does not include license fees – which start at $3,900 — see pricing below. View full performance & disclaimers here. Source for S&P 500 Sharpe ratio is Morningstar based on past 5 years as of Dec, 2024.

Past performance may not be indicative of future results.

You’ve likely heard us mention “volatility is our friend” and may be wondering what that means in light of our returns last month while volatility increased. Generally speaking, when volatility expands win rates decline slightly, but the profits per win increase significantly. This means the returns within the programs also become more volatile on a day-to-day basis. The presence of volatility over a few days is helpful, but a sustained period of volatility is the key as even a small winning streak strung together in a higher volatility environment can easily result in 20%+ returns in a single month due to the asymmetric return potential of each program. This is not theoretical but how they actually trade and can be seen when evaluating the monthly returns for each program.

Another Reason to Be Optimistic in 2025

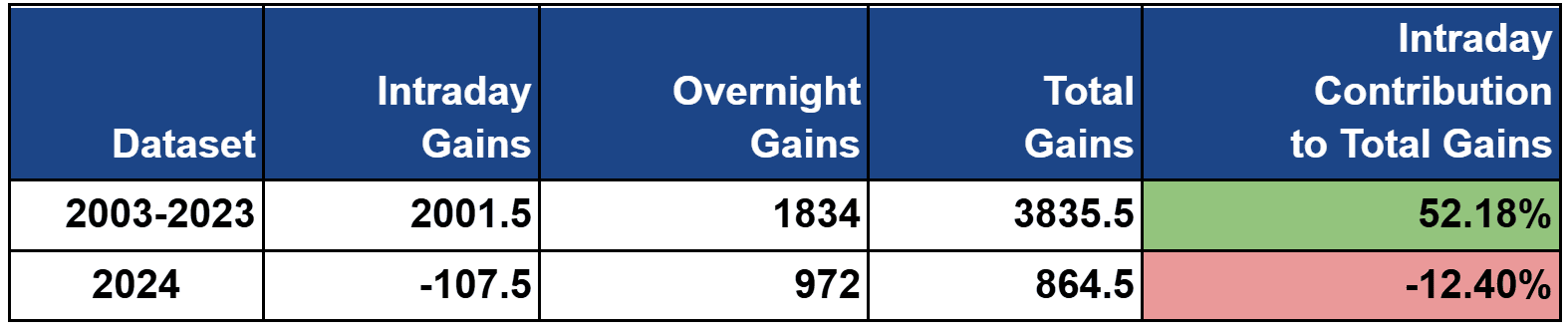

In last month’s update, we shared four reasons we are optimistic about autotrading this year. Here’s another: Market patterns tend to follow historical norms, but 2024 broke the mold in a way that’s unlikely to be repeated anytime soon. Unlike the vast majority of years, where both overnight and intraday sessions contribute meaningfully to total market movement, 2024 saw ALL of its gains occur overnight, with 112% of the yearly gains occurring after hours. Intraday price action gave back about 12% of those gains. You read that right: while the S&P was notching its most bullish two year stretch in nearly 30 years, institutional investors were selling (a scenario that has only occurred 3 times in our multi-decade database).

The table compares 2024 to the prior 2 decades total points gained in the intraday and overnight sessions of the S&P 500 futures.

The lack of intraday market gains is why our “long” strategies struggled so much in 2024. Fortunately, our short strategies did quite well and helped the Select 150, Max 150 and Max 500 programs generate modest gross gains for the year. However, with the exception of Meta 50, our smallest programs (which are less diversified), did not.

Analysis of the year following those 3 other years in our database (in which intraday prices declined while the S&P finished higher) show that the following year returned to a more normal pattern and intraday contributed to over 60% to the subsequent year’s total annual gains on average. As a result, we believe it is unlikely that last year’s unusual price action will persist in 2025 – and that should help our programs deliver more typical returns in the year ahead as our long strategies get back on track.

Why Now? Two (More) Reasons…

One of our goals this year is to help our clients (new and existing) take better advantage of the iQ autotrading programs' adaptive and self-regulating designs BEFORE our programs capture their next big run up. Though investing while a program is in a drawdown can be difficult psychologically, doing so can generate outsized returns with less drawdown risk. Here’s two additional reasons get started now:

1) Help Us Help Them!

For anyone who licenses a new autotrading unit of any iQ program, we will donate $300 to Folds of Honor – a tremendous non-profit where over 90% of donations go directly to life-changing educational scholarships for the spouses and children of America’s fallen disabled military and first responders (like the heroes who risked their lives saving thousands from the devastating natural disasters of late). Last year, InvestiQuant donated $15,000 to FoH. Learn about FoH and InvestiQuant’s 2024 support here and help us do more now.

2) February Promo for the iQ Select 150 Program

Take advantage of the Select 150’s pullback in returns and use our Pay With Profits (PwP) option to purchase this popular autotrading program in February. Email [email protected] for details.

iQ Autotrading programs are licensed annually and fees equate to a small percentage of each program’s Average Annual ROI. Prices start at $3,900. Request details and payment options here. Discounts are available for veterans of the military and law enforcement. Larger programs and volume discounts are available for family offices and investors seeking to invest with greater amounts. Email [email protected] for details.

Want To Learn More?

Check out Answers to Common Autotrading Questions here. If you would like to request a 1-1 call/meeting with Matt, email [email protected]. You can also schedule a Zoom call/meeting with me here. Or, get your questions answered at our upcoming webinar:

Thought of the Month

"Do not wait; the time will never be ‘just right.’ Start where you stand."

– Napoleon Hill

Invest Smarter.

Scott Andrews

InvestiQuant.com

CEO & Co-Founder