July Performance

Volatility Is Back - What Does That Mean for Autotrading?

Did You Know?

August 14th Webinar: Get Your Questions Answered

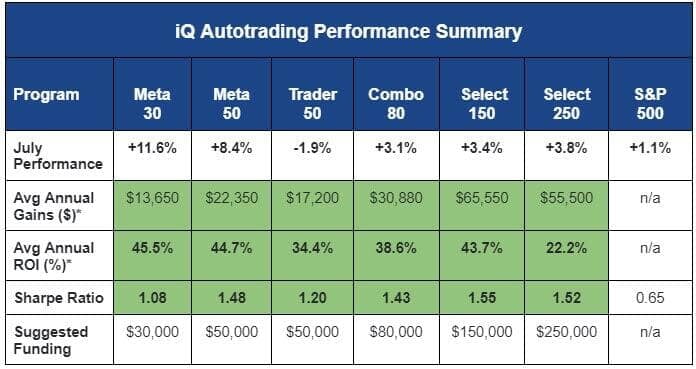

The S&P 500 equity index (SPX) started strong, but rolled over mid-month and gave back most of its gains as sellers came back into the market. As is often the case, the spike in volatility was enough to propel 5 of the 6 iQ autotrading programs to outperform the SPX with Meta 30 leading the way, up 11.6% for the month.

Meta 50 and Select 250 finished at all-time highs in July. More impressively, Meta 30 has generated more than 40% in gains over the past 10 weeks - illustrating the tremendous account growth and “rapid drawdown recovery” potential of the iQ autotrading programs.

* Returns based on live and simulated returns since 2018, using suggested funding. Does not include license fees - which start at $3,900 - see pricing below. View full performance & disclaimers here. Source for S&P 500 Sharpe ratio is Morningstar based on past 5 years as of July, 2024. Past performance may not be indicative of future results.

Volatility is Back. What Does That Mean for Autotrading?

If you have followed us for any length of time you know that we prefer volatile markets. Well, they’re back. So let’s go over what that means for our programs and clients.

You can think of volatility as the fuel that drives the profit opportunity for our strategies. Simply put, when volatility is lower, profit opportunity is lower - and when volatility is higher, profit opportunity is higher. Let’s look at an example with some data.

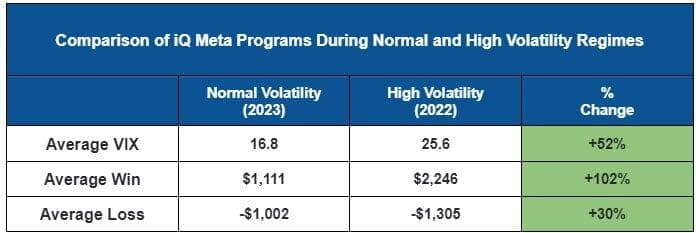

The VIX is a common measure of volatility. The larger the number, the greater the expectation of future market volatility. The VIX long term average is around 19; currently it is above that. However, for the first 6 months of the year the average VIX was 13.8 - lower than any year since 2017. (By comparison, it was considerably higher in 2023 with an average of 16.8, and 25.6 in 2022.)

In the table below we compare recent examples of markets with normal volatility (2023) and high volatility (2022). We will use our Meta programs to show how the different volatility levels can impact autotrading performance for some of our programs.

As the data illustrates, there can be <double> the profit potential when the markets are volatile, with only a small increase in the risk required. That’s because the potential profits per trade are unlimited, while the maximum potential loss is capped by each program’s daily risk limit. This is what we call “asymmetric return” potential. To put it into real-time perspective, last week both Meta programs took a trade that risked ~$1,500 and finished with a profit of over $4,700 for the day. That math works.

So why don’t our algos only trade when the VIX (expectation of futures volatility) is normal or high? In a nutshell, volatility (and the many ways of measuring it) is a core factor that is evaluated everyday by our AI / machine-learning engine. And, we have strategies which are designed specifically for performing well during lower volatility environments. Plus, volatility spikes can occur at any time and missing them can be quite costly (in terms of missed profits.)

Bottom Line: Volatility appears to be back and that should increase the magnitude and frequency of high profit trades for the iQ autotrading programs for the foreseeable future. As always, “should” does not mean “will,” but the odds are in our favor.

Did You Know?

Risk management is the first priority at InvestiQuant and not all volatility is good when autotrading. There are rare periods when market volatility can be so high that the daily risk required to properly execute some trades exceeds the risk tolerances for a program. In these situations, the strategies will “auto-pause” and wait until the market settles down enough to safely resume trading. Meaning your account’s trading activity may slow down or even stop and sit safely in cash and out of harm's way for a week or two until the extreme volatility spike abates.

Pricing and Discounts

iQ Autotrading programs are licensed annually and fees equate to a small percentage of each program’s Average Annual ROI. Prices currently range from $3,900 - $9,900. Request details and payment options here. Discounts are available for veterans of the military and law enforcement. Larger programs and volume discounts are available for family offices and investors seeking to invest with greater amounts. Email [email protected] for details.

Client referrals are one of our top generators of new clients. Make an intro and we’ll do the rest. You both will save $500. Contact [email protected] for details.

Want To Learn More?

Check out Answers to Common Autotrading Questions here. If you would like to request a 1-1 call/meeting with Matt, email [email protected]. You can also schedule a Zoom call/meeting with me here. Or, get your questions answered at our upcoming webinar:

Thought of the Month

"History never repeats itself. Man always does"

- Voltaire

Invest Smarter. Every Day.

Scott Andrews

InvestiQuant.com

CEO & Co-Founder