In today’s increasingly complex and fast-moving markets, simply diversifying across asset classes is no longer sufficient. Many investors believe they’re protected by holding a mix of stocks, bonds, and mutual funds, but when volatility strikes, correlations often converge, and portfolios drop in unison. This is called “crisis correlation,” That’s why the smartest investors fill their portfolios with lowly correlated strategies—investments that don’t move in lockstep with others, especially during periods of market stress.

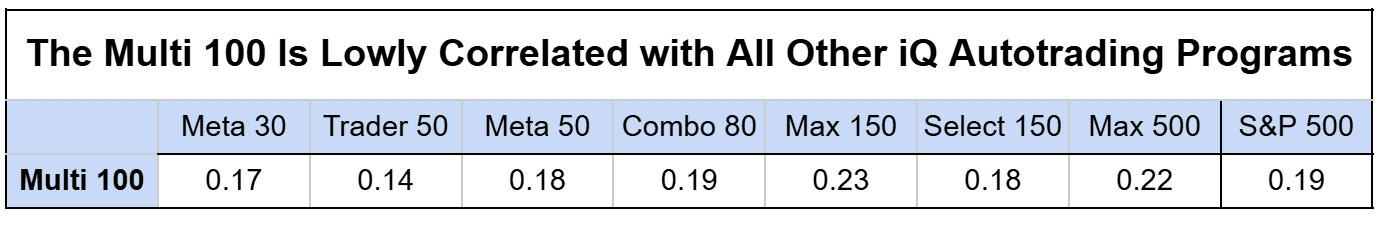

Just how different is the Multi 100? The table below shows its correlation with the S&P 500 and our other iQ Autotrading programs. These values range from just 0.14 to 0.23, indicating a very low level of correlation across the board:

Low correlation means that Multi 100 can zig when other investments and strategies zag. It reduces overall portfolio volatility and increases the likelihood of achieving more consistent, long-term returns, especially when paired with other automated systems or traditional investments. In a world where market regime changes are accelerating and shocks are more common, adding lowly correlated return streams isn’t just a good strategy, it’s essential.