Blog by Matt Ratliff

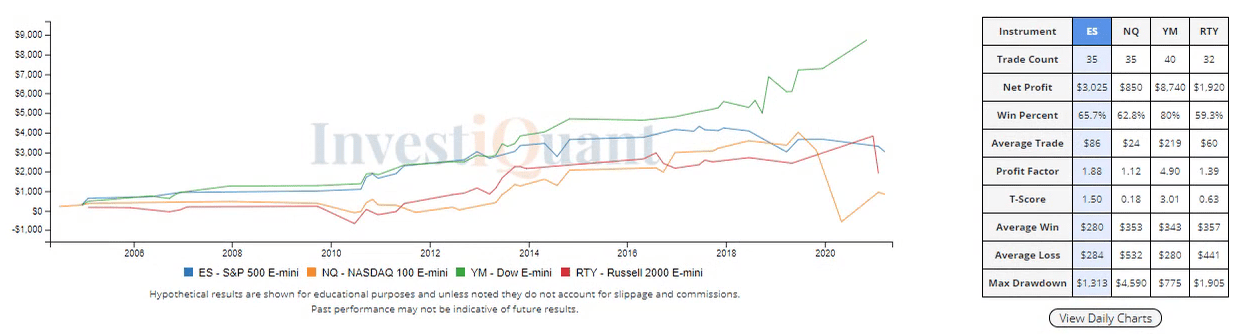

The markets have outside day candlesticks forming, let's see what that has led to into the close.

The markets are breaking higher out of a 3-day balance area, let's use a market profile pattern to see what that has led to historically.

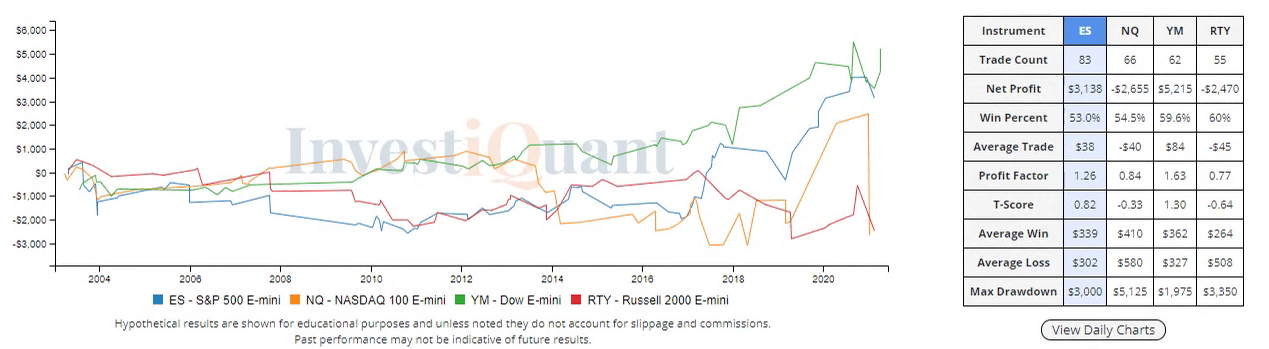

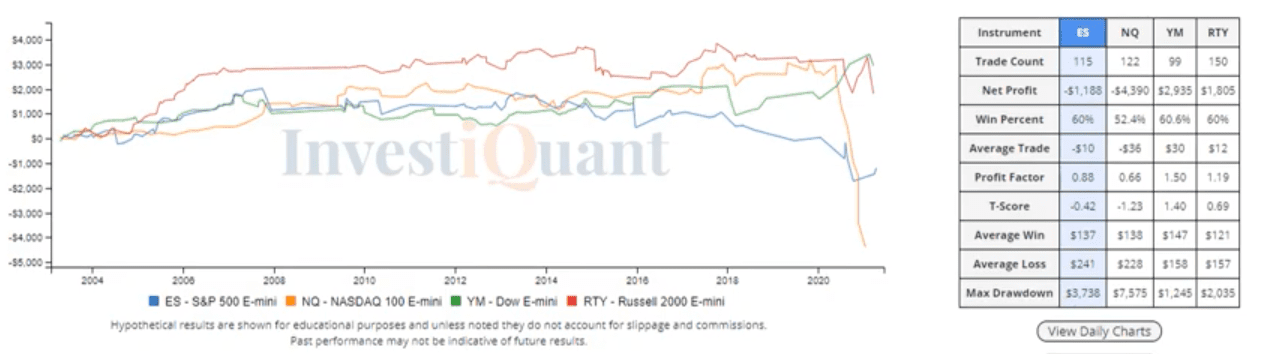

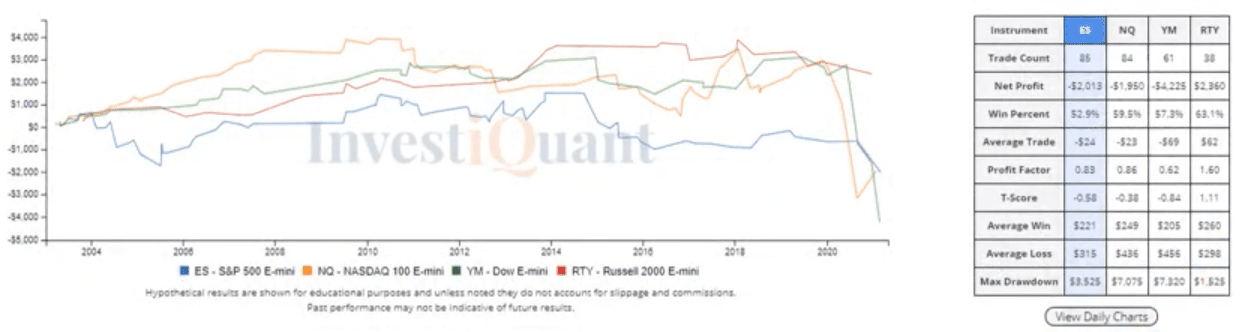

Today is the FOMC announcement, let look at what has happened on this day historically. Today we conduct 2 studies.

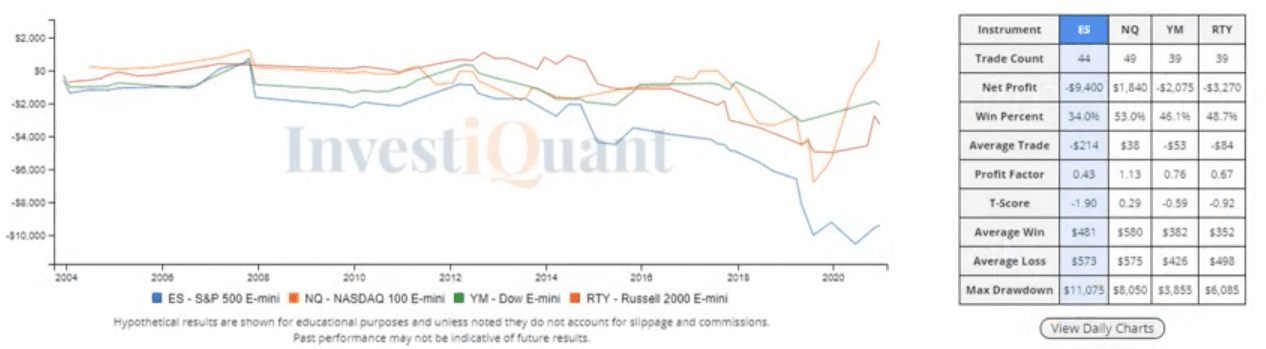

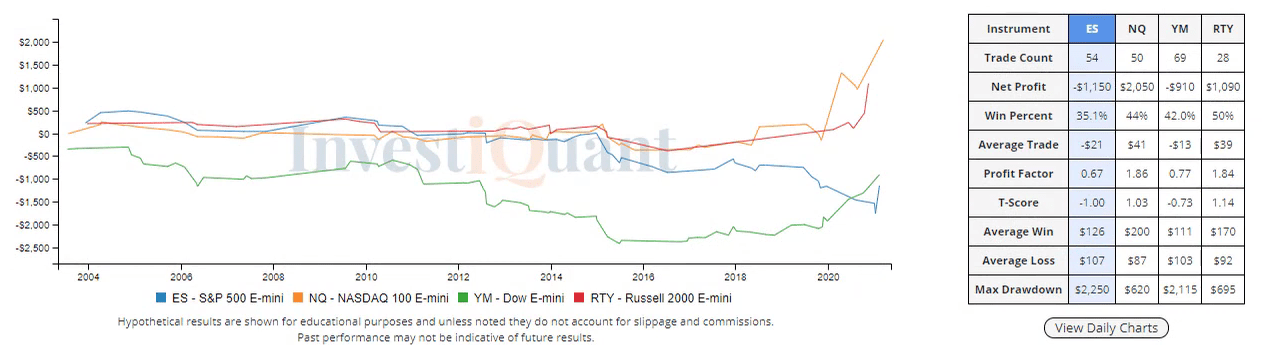

The markets are trading down as we approach the close ahead of tomorrow's FOMC announcement. Here is what that has led to historically.

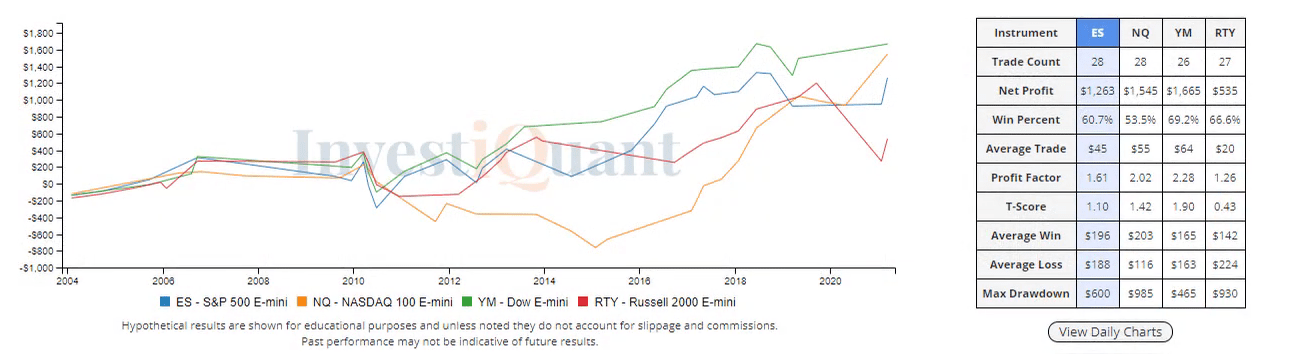

The markets are trading higher this morning on the day before the FOMC announcement, let's see what this has led to historically.

The markets are consolidating tightly today, let's see what that has led to on Mondays.

The markets finished the week strong on Friday and are flat ahead of the open on Monday, let's study that pattern.

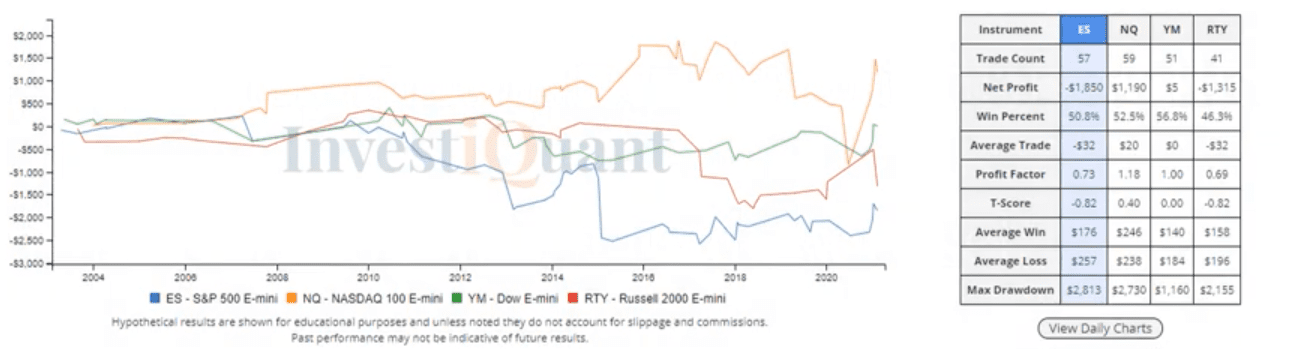

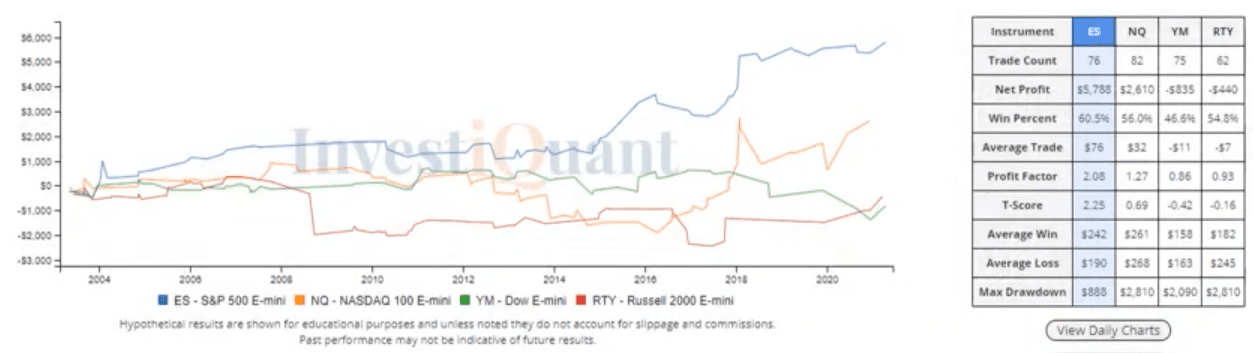

Yesterday put in a bearish outside day candlestick pattern, let's see just how bearish that candlestick is...

The markets are selling off on news after testing higher, let's see what this pattern has led to as we approach the close.

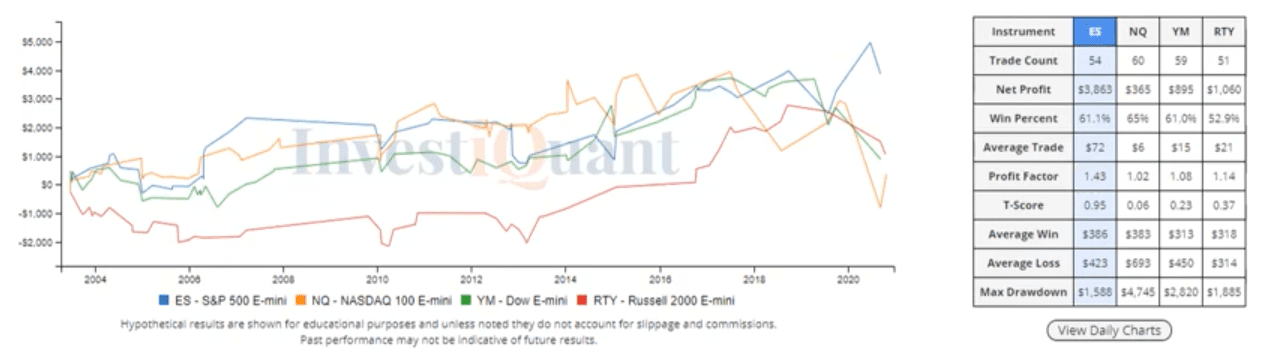

The markets trended higher yesterday and are consolidating overnight, let's see what that has led to historically.