In this month’s update…

- June Performance

- Is Starting with the Smallest Autotrading Program the Best Move?

- What’s New

- Did You Know?

- Pricing & Discounts

- How to Learn More

Performance Review

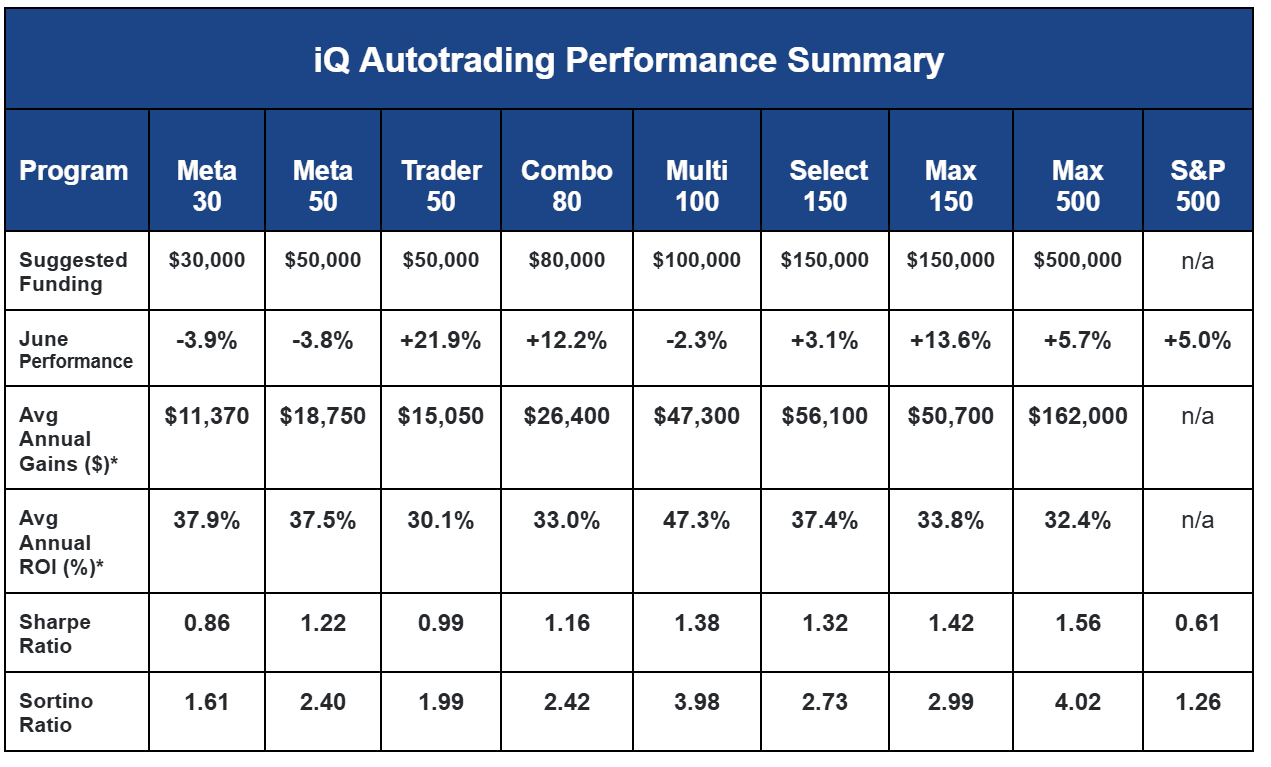

Equity markets closed Q2 on a high note, driven by geopolitical optimism and strength in tech stocks, with the S&P 500 finishing up +5%. Five iQ autotrading programs also posted gains in June, ranging from +3.1% to +21.9% (average: +11.3%), with three delivering strong double-digit returns. After a challenging stretch, our Trader 50 program had its best month ever in live trading (since 2021)—up +21.9%. Combined with its +7.6% gain in May, it has now recovered 56% of its year-long drawdown in just two months—highlighting how quickly adaptive strategies can rebound when market behavior aligns with historical patterns.

* Returns based on live and simulated results since 2018, using suggested funding. Does not include license fees – which start at $3,900 - see pricing below. View full performance & disclaimers here. Source for S&P 500 Sharpe ratio is Morningstar based on past 5 years as of Dec 2024. Past performance may not be indicative of future results.

Is Starting with the Smallest Autotrading Program the Best Move?

Over the years, we’ve observed an interesting—but often counterproductive—pattern: many well-funded clients begin their InvestiQuant journey with the smallest iQ autotrading program, even when it's just a fraction of their intended investment or risk tolerance. On the surface, this seems like the most cautious way to start. But in practice, it’s not always the most effective, comfortable, or representative experience—especially when equity markets hit a rough patch (i.e. deviate from historical patterns, leading to declines in one’s autotrading account equity—also known as a “drawdown”).

In fact, starting too small can amplify the emotional strain of volatility and lead to an experience that feels misaligned with your expectations. In some cases, it has even led clients to withdraw entirely—missing out on compelling, portfolio-enhancing returns. That’s why we encourage clients, when starting out, to select a program—or a mix of programs—that truly reflects their financial goals, risk tolerance, and available capital, rather than defaulting to the lowest entry point.

Why Funding Level and Drawdown Matter

One of the most important factors to consider is historical drawdown in relation to required capital. Larger programs benefit from greater diversification and thus tend to have lower drawdowns as a percentage of their funding–offering more cushion during underperformance and reducing the emotional pressure that sometimes causes investors to abandon otherwise sound strategies.

For example, a well-funded investor with a goal of putting $100K (or more) to work at InvestiQuant, would be having a very different experience if they started with the Meta 50 this year instead of the Multi 100, Max 150, or Max 500 which have enjoyed more stable equity curves and a smoother experience overall.

(Tip: To be clear, we are not suggesting “going all in” on one’s initial investment either. If able, it’s smart to preserve some dry powder (additional funds) to take advantage of future drawdowns, which are often excellent entry points.)

A Better Way to Compare Programs

To evaluate performance more meaningfully, we recommend focusing on the Sortino ratio, which measures return relative to downside volatility. Unlike the Sharpe ratio, Sortino does not penalize programs for large winning months—making it a more relevant metric for autotrading strategies.

You can find Sortino ratios, funding levels, drawdowns, and return data in our performance reports and within the iQ Portfolio Builder, which makes side-by-side comparisons simple and intuitive.

Bottom Line: Smaller Isn’t Always Safer

A well-funded, well-diversified program with modest drawdowns and a strong Sortino ratio may offer a more stable, less stressful, and ultimately more successful autotrading experience over the long run.

What’s New

In Q2, we integrated improved execution techniques in several of our larger programs that spreads out entry times more effectively. We’re excited as it has already demonstrated improved performance in the strategies it affects. Additionally, this approach provides an added layer of diversification within the programs, further strengthening the overall trading process.

iQ Autotrading programs are licensed annually and prices start at $3,900. Request details and payment options here. Discounts are available for veterans of the military and law enforcement. Larger programs and volume discounts are available for family offices and investors seeking to invest with greater amounts. Email [email protected] for details.

Want To Learn More?

Check out Answers to Common Autotrading Questions here. View autotrading performance via the popular iQ Portfolio Builder here. If you would like to request a 1-1 call/meeting with Matt, email [email protected]. You can also schedule a Zoom call/meeting with me here.

Thought of the Month

“The best way to predict the future is to create it."

— Peter Drucker

Scott Andrews

InvestiQuant.com

CEO & Co-Founder