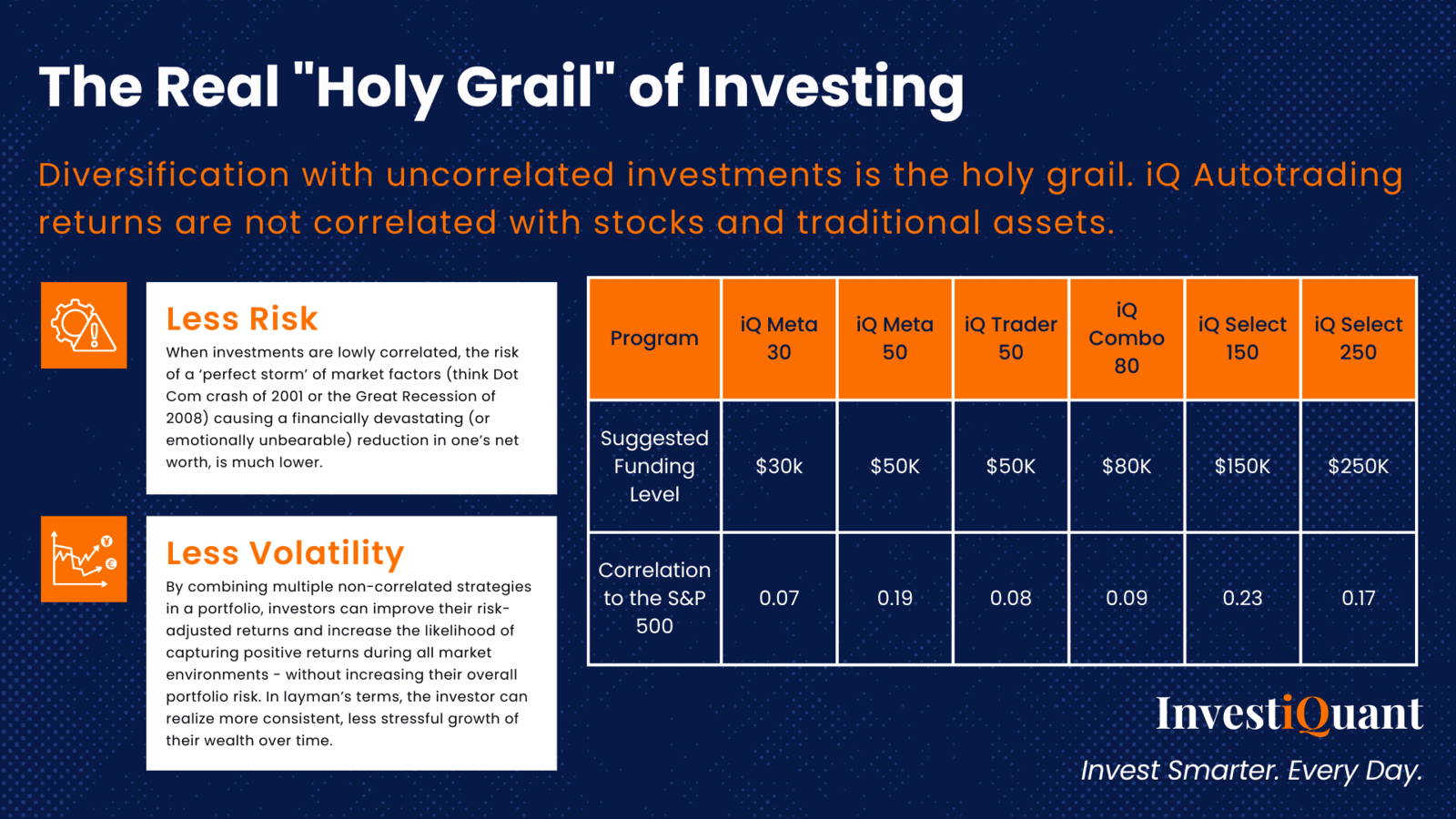

The Real "Holy Grail" of Investing

If you’ve followed InvestiQuant for a while, you’ve probably heard us quote Ray Dalio’s mantra that diversification is the holy grail of investing. But actually, it’s not. Diversifying one’s wealth across investments that move in tandem with one another is of little value to an investor. The key to unlocking the benefits of portfolio diversification lies in the concept of low or no correlation.

Correlation refers to the statistical relationship between different assets or investment strategies. It can be positive, negative, or zero. Positive correlation means that two assets tend to move in the same direction, while negative correlation suggests they move in opposite directions. Zero correlation means there is no apparent relationship between their movements. Non-correlated (a.k.a. uncorrelated) strategies have a correlation between -.1 and .1. The closer the value is to +/- 1.0, the more positively correlated / negatively correlated the strategies are to one another. Why is this important? Because diversification alone is not enough when investing.

Diversification is the practice of spreading one’s wealth across different assets or strategies with the aim of reducing risk. However, diversifying across highly correlated instruments, for example Apple and QQQ, does not reduce one’s risk since they will rise and fall in near lock-step with one another due to their values being driven by the same market factors. However, by diversifying with low-correlated investments, investors can minimize the odds that all of their investments will underperform at the same time. The inclusion of unrelated assets helps smooth out the overall performance of the portfolio and cushion against losses incurred by any single investment or segment.

When assets and investment strategies perform independently of one other, they provide two significant advantages to investors:

Less Risk - When investments are lowly correlated, the risk of a ‘perfect storm’ of market factors (think Dot Com crash of 2001 or the Great Recession of 2008) causing a financially devastating (or emotionally unbearable) reduction in one’s net worth, is much lower.

Less Volatility - By combining multiple non-correlated strategies in a portfolio, investors can improve their risk-adjusted returns and increase the likelihood of capturing positive returns during all market environments — without increasing their overall portfolio risk. In layman’s terms, the investor can realize more consistent, less stressful growth of their wealth over time.

The real holy grail? Diversifying with investments that are proven to be lowly correlated in both good and bad economic times.

(Tip: Many stock related investments can appear to be lowly correlated in bullish markets, but in reality be highly correlated in bear markets. This concept is called “crisis correlation” and savvy investors should carefully consider this dangerous phenomenon when constructing their portfolios.)

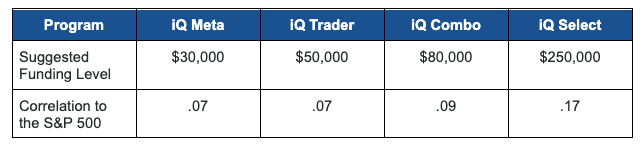

Appropriate non-correlated investments will vary for each investor based on the components of their portfolios. However, most traditional stock investors can benefit from the low correlation between iQ Autotrading and equities: Here’s a table of the iQ programs and their correlation to the S&P 500.

Invest Smarter. Every Day.

Invest Smarter. Every Day.