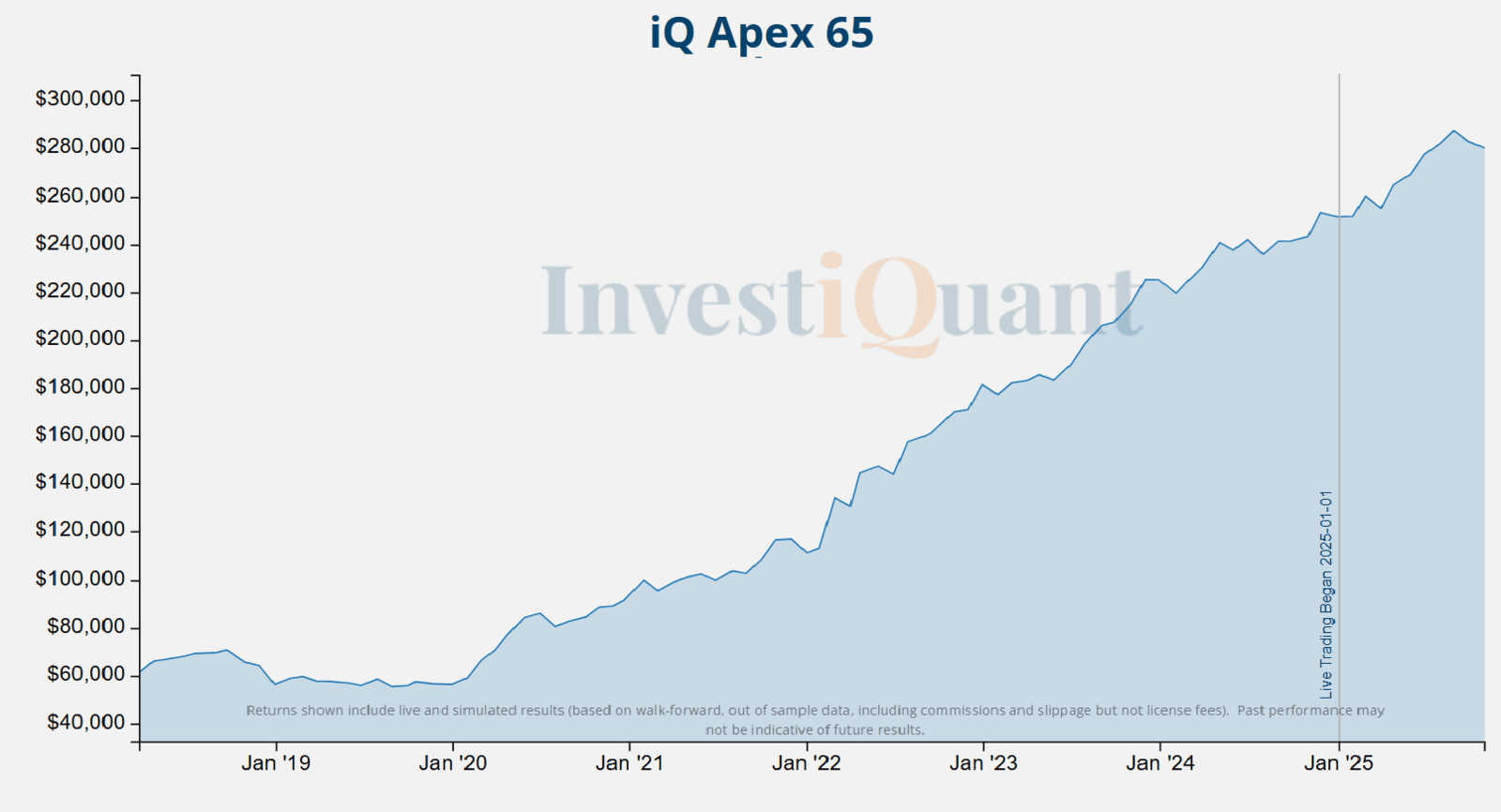

Designed with our lowest entry requirement for a multi-market strategy, Apex 65 trades exclusively intraday in the E-mini S&P 500 and NASDAQ futures markets.

Apex 65 executes up to one E-mini contract per day—selecting only those setups that exhibit high win probability or exceptional reward-to-risk potential, all while remaining within strict daily risk limits.

Designed with our lowest entry requirement for a multi-market strategy, Apex 65 trades exclusively intraday in the E-mini S&P 500 and NASDAQ futures markets.

Apex 65 executes up to one E-mini contract per day—selecting only those setups that exhibit high win probability or exceptional reward-to-risk potential, all while remaining within strict daily risk limits.

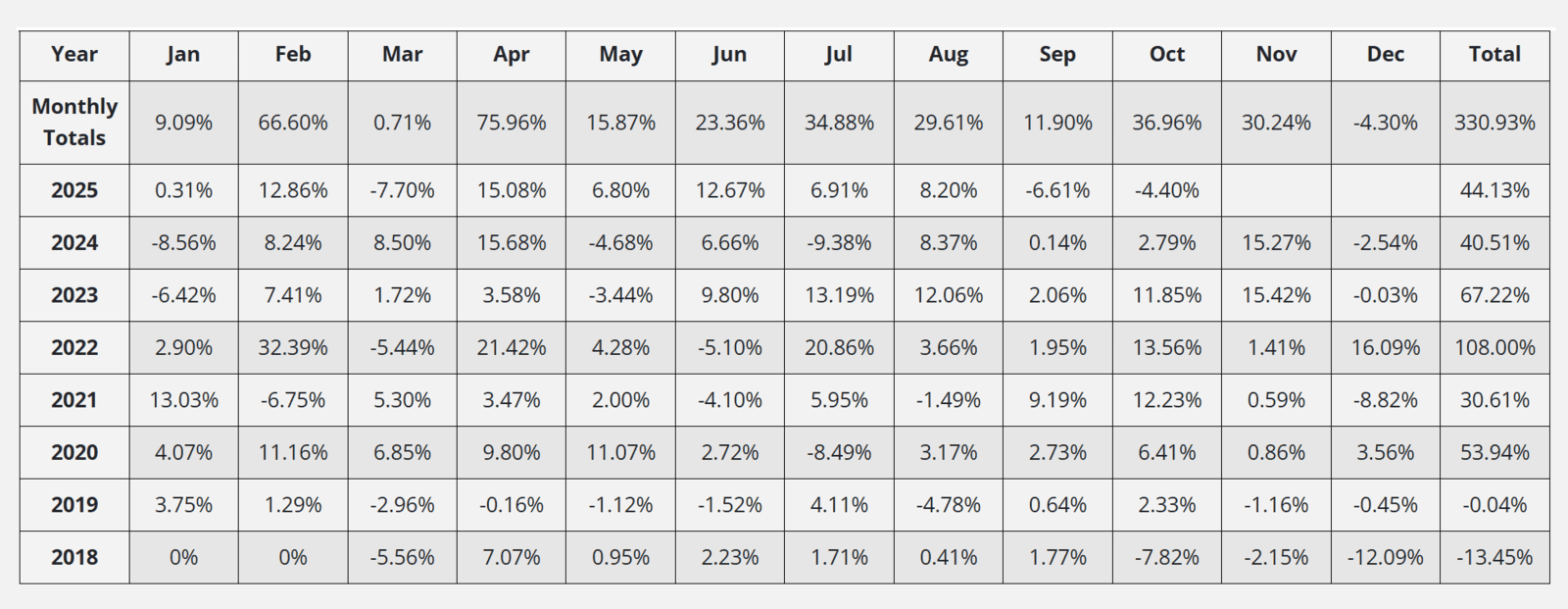

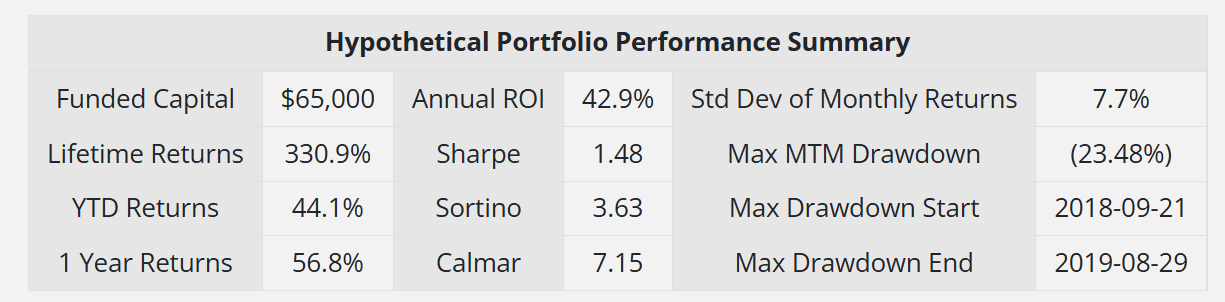

Futures trading programs have large potential rewards, but also large potential risks and are not suitable for everyone. You must be willing to accept these risks in order to invest in the futures markets. The past performance of any trading system or methodology is not necessarily indicative of future results and may not account for license fees. You should expect larger drawdowns in the future than those shown in historical and hypothetical results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

InvestiQuant is not a registered commodity trading advisor and does not provide personalized advice. Only consider futures trading and notional funding after careful consultation with a futures broker.