In this month’s update…

- Performance of iQ Autotrading Programs

- 2022 Crisis Correlation Chart

- Be a Great Pilot

- What’s In Store for 2023?

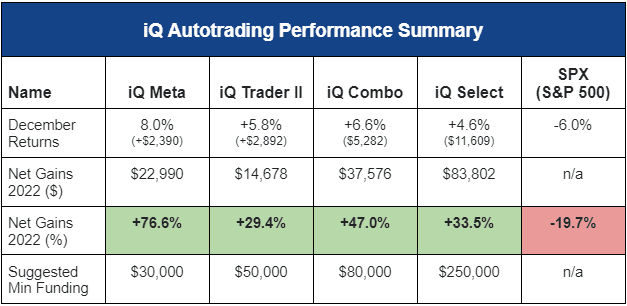

The S&P 500 index (SPX) tumbled again in December, losing another 6%. iQ Autotrading Programs were very selective in December and, despite the lighter-than-normal trading activity, all four were able to enjoy solid gains and finish at new highs for the year.

* Based on live, net brokerage results (not hypothetical), and suggested minimum funding. Does not include license fee. Past performance may not be indicative of future results. View full performance & disclosures here.

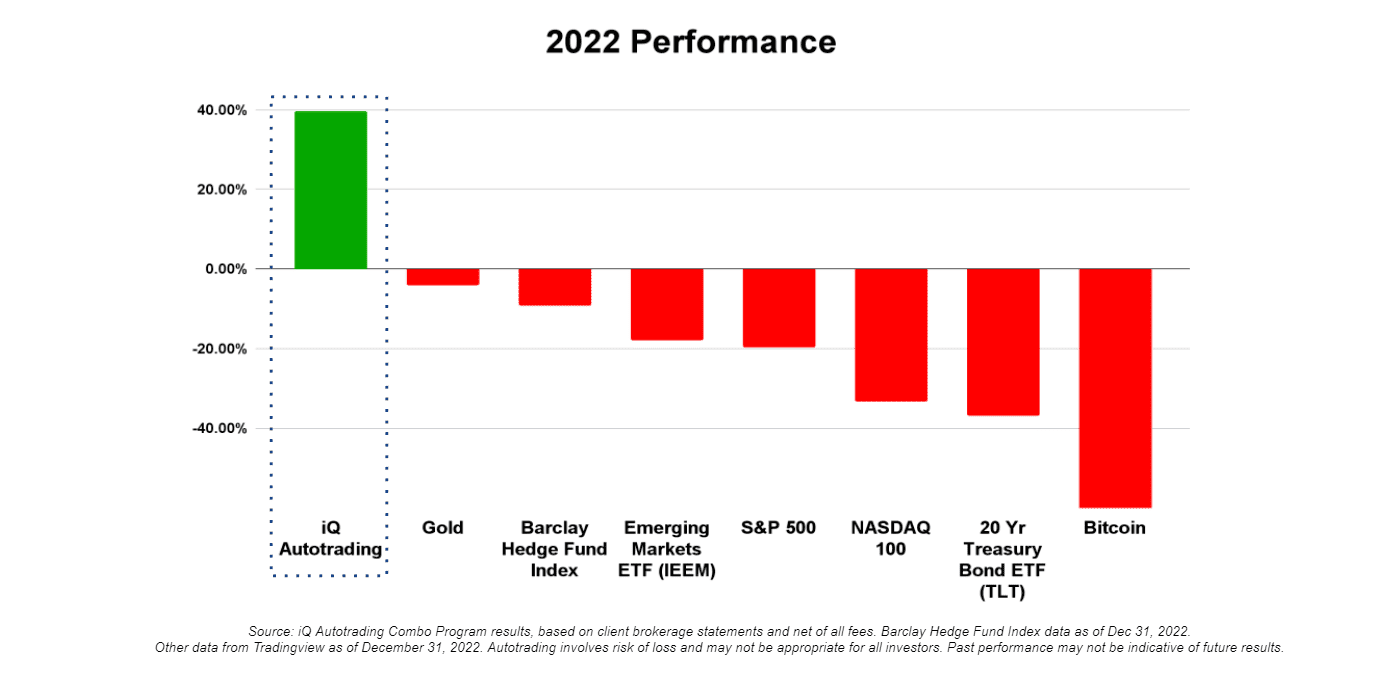

2022: A Year of Crisis Correlation

If there was ever a textbook year that highlighted the need for investors of all sizes to better diversify their investments it was 2022. As we wrote in our monthly update in January last year,

“One of the hidden market risks that all equity investors face is crisis correlation: the tendency of financial markets around the globe to move in unison to the downside during bear markets and times of stress. When investors need traditional diversification to help them the most, it often fails. That is why it is important for investors to have exposure to liquid alternative investments (like iQ Autotrading programs) as part of their portfolio strategy. By actively trading both long and short, and using strategies that are fueled by volatility, iQ clients can

often profit, while the rest of the markets sell-off in tandem.”

(Learn more about “crisis correlation risk” in this white paper: A Study of Traditional Asset Correlation in the New Millennium.)

The traditional method of spreading your capital across multiple asset groups like stocks, bonds, metals, etc., simply does not work. While investors worldwide endured massive reductions in wealth in 2022, hundreds of iQ clients enjoyed the stabilizing effect of sophisticated, proprietary, market-adapting strategies trading their accounts both long and short.

Be a Great Pilot

It’s easy to sit here and bask in the glory of a great year, but we would be remiss to not remind our clients and prospects that it was not always easy. It never is. Each of the iQ Programs suffered losing periods throughout the year. iQ Meta, our highest-performing program in 2022 (+76.6%) only made profits in 6 of the 12 months. There was also a streak of 3 consecutive losing months just before delivering its most profitable one ever. (Sadly, a few clients paused or canceled their accounts after Meta lost 24% in August and September - and missed the +48% in gains it captured from October through December.)

The other iQ programs are more diversified (many different strategies versus just one) and were able to generate gains in 8-9 months of the year. Still, some like iQ Trader chopped sideways for long stretches (losing 4% during one 6-month period) before breaking out and generating over 21% in profits in the final 3 months of the year.

The key takeaway here is that iQ autotrading requires patience. There is always the random chance that you will begin autotrading (or add to your allocation) just before a handful of losing trades or months in a row. But as long as you remain patient, the odds heavily favor recovering those losses and earning a nice return in the not-so-distant future. As my crusty ol’ flight instructor from Fort Rucker, Alabama used to say, “focus on the horizon and ignore the turbulence!”

What’s in Store for 2023?

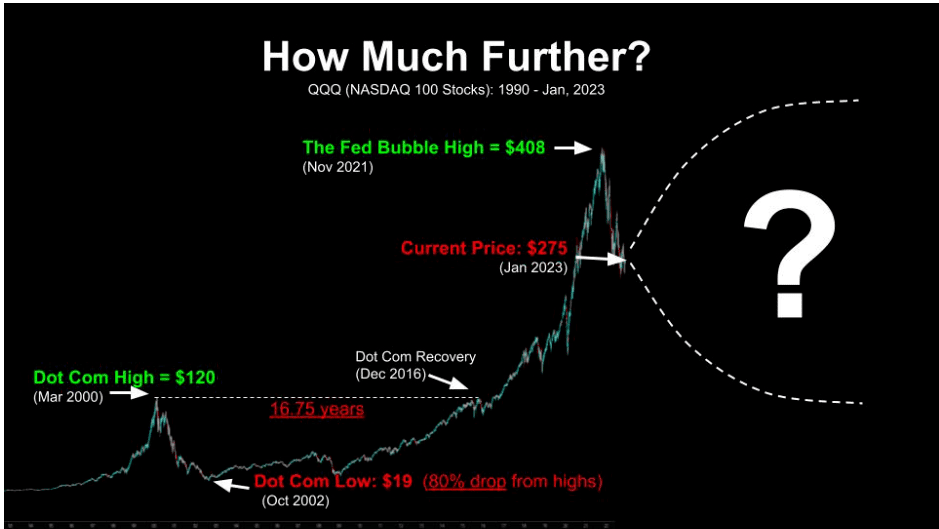

No one knows of course. However, as this chart illustrates there is plenty of ‘technical’ room for equities to move in either (or both) directions in the coming year:

In The News

- Dec 20: Morgan Stanley warns US profits could drop like in 2008, tanking stocks

- Dec 8: BlackRock (the world’s largest asset manager) says get ready for a recession unlike any other and 'what worked in the past won't work now'

- Dec 5: Economist Roubini sees 'Mother of All Stagflationary Debt Crises’

Pricing and Discounts

iQ Autotrading programs are licensed annually and fees equate to ~20% of each program’s Average Annual ROI. Prices currently range from $3,900 - $9,900. Request details and payment options here. Discounts are available for veterans of the military and law enforcement. Multi-unit license discounts are available for family offices and large investors. Email info@investiquant for details.

Client referrals are one of our top generators of new clients. If you know someone who needs more (or better) diversification, make an intro and we’ll do the rest. You both will save up to $1,000. Contact [email protected] to learn more.

Thinking About Getting Started?

Want to learn more, go to: https://www.investiquant.com/request-information-autotrading. You may also email [email protected] to schedule a 1-1 call/meeting. Or, get your questions answered at our next webinar. Our executing broker will be there to handle account-related questions:

Thought of the Month

“Risk Management lets you appreciate the risk

while you let someone else shoulder all the worry.”

- Anthony Hincks