15

Years Serving Investors

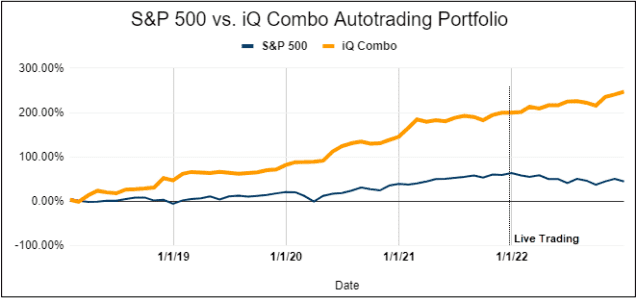

46%

Average 2022 Return

> 20

Countries Served

Why Autotrade with IQ?

✔ Potential for high double-digit returns. Strong returns in 2022.

✔ Proven portfolio smoother Not correlated with stocks, bonds, or gold.

✔ Integrity & trust. Program created & traded by West Point graduates.

✔ Sleep well at night. No overnight trades, risk, or surprises.

✔ Safe & Secure. 24/7 control, access and visibility of your account.

Why Choose InvestiQuant?

Since 2008, InvestiQuant has armed serious investors and professional traders with institutional-quality trading strategies based on statistical edges.

Don’t just take our word for it! Hear what our clients have to say about their experience using our autotrading tools.

I have been a continuous client of iQ for about a dozen years. This speaks to the trust I have in and service I have received from iQ over the years. I am an experienced Equity Futures trader (thousands of contracts traded) and started with their S&P 500 auto-trading systems in November of 2020. My returns to-date have been excellent. This is a great fit for someone looking for a professionally managed, back-tested, leveraged, auto-trading Equity Futures system to add diversity to their trading or investment portfolio

- Jeff B., Client since 2008

The 2008 Financial Crisis took the shine off our simple leveraged buy and hold investment strategy. Seeking a better approach we discovered Scott and his team. We are an international couple and appreciate how easy, hands free and accessible the S&P auto-trading portfolio is. We use the iQ platform as a currency and investment hedge analyzing market conditions in a way we could never replicate as retail traders

- Matt, Client since 2018

Your investment is totally turnkey. Once you sign up and fund your account, there is literally nothing else that you have to do. You get daily reports on trades taken for your account, and a single year-end 1099 for tax purposes. And if held in a taxable account, 60% of the net gains are taxed at the Long Term Capital Gains rate. You are in total control, as you can halt trading in your account at any time. I have an engineering degree and an MS in Statistics. While nothing in the investment world is guaranteed, this checked all my boxes.

- Dom B., Client since 2018

I am impressed with their staff's professionalism and great customer service. I had several conversations with Scott before I signed up for their service, Scott was very professional, transparent, and never downplayed the risk associated with the trading (which would be a big red flag to me). Matt has been very helpful in resolving several issues I have had, absolutely great customer service.

- H. Sun, Client since 2022

I have been a subscriber with Scott and his team at InvestiQuant since 2013 when I used to listen to his daily updates on the markets and subscribe to his gap fill probabilities. I used his data to successfully trade the opening gap for many years when I was a trader on Wall Street. I used to listen to Scott’s takes on the market every morning before it opened. I attended a trading seminar he gave in 2015 and also presented at that conference on a similar ensemble approach I took on trading longer time frames. When I left Wall Street and started my own business in 2016, I found myself having less time to actively trade. By that time, my trust in their approach to trading the markets had grown to the point that I decided to invest in their program rather than trade it myself. Their deep knowledge of trading and their passion to continuously adapt their models to ever changing markets gave me confidence that they would do a better job than I could. This allowed me to focus my time on building my own business, a win-win decision for me.

-Mike F., Client since 2013

I developed my interest in the markets back in 1999 and have been following you and your team since "Master The Gap" days. I have seen all kinds of trading offerings out there and can honestly say that the quality of the work you and your team does really stands out. Having seen what your team has accomplished, I can only assume that tens, if not hundreds, of thousands of hours of hard work needed to be put in to get this far. I am excited to be onboard with the program.